insolvent trading

Insolvent trading in context

Insolvent trading is one of the many items for review recommended by the Parliamentary Joint Committee report on Corporate Insolvency. ...

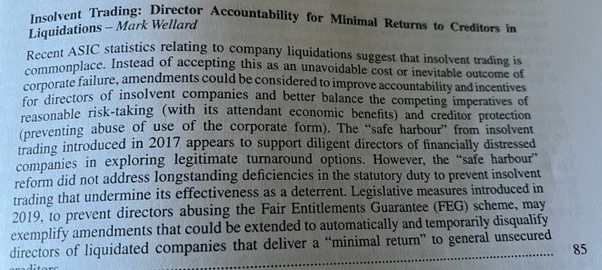

Insolvent Trading and Minimal Returns to Creditors in Liquidations

05/10/2023

insolvent trading deterrence

This is a brief response to a well-researched and thoughtful article by Associate Professor Mark Wellard – Insolvent Trading: Director ...

NZ Supreme Court confirms Mainzeal directors’ liabilities for over NZ$39 million

25/08/2023

insolvent trading NZ

The Supreme Court of New Zealand has dismissed directors’ appeals from a finding that they must pay over NZ$6 million ...

Australia’s safe harbour protection from insolvent trading liability, continued

05/04/2022

insolvent trading safe harbour

The report on Australia’s safe harbour protection for directors (s 588GA) from what is said to be our strict insolvent ...

Australia’s review of its insolvency safe harbour – more than a few issues to consider, but in the end, about not much

06/09/2021

insolvent trading safe harbour

The terms of reference and what is called a ‘discussion paper’[1] for this review under s 588HA have been released, ...

Review of Australia’s safe harbour protection from insolvent trading – remember s 588HA [updated]

23/08/2021

insolvent trading safe harbour

The federal government has finally made arrangements to have Australia’s “safe harbour” from insolvent trading law reviewed – s 588GA, ...

Insolvent trading convictions set aside on mental health grounds

16/06/2021

Crime insolvent trading

Following convictions and imprisonment for insolvent trading arising from the 2009 collapse of Kleenmaid, its founder, Andrew Young, has succeeded ...

An insolvency safe harbour based on culture and tradition?

04/05/2021

insolvent trading CATSI Act

For years Australia had no ‘safe harbour’ protection for directors from insolvent trading. In 2017, one was introduced, then three ...

Is Australia’s insolvency safe harbour protection working – who knows?

30/10/2020

safe harbour insolvent trading Articles

The 2 year review of Australia’s safe harbour protection for directors, due from the government over a year ago, never ...

Duties of directors of insolvent companies – New Zealand Supreme Court decision

29/09/2020

insolvent trading NZ reckless trading articles

The NZ Supreme Court has given a significant decision on the duties of directors in the face of their company’s ...

Extension of the COVID-19 insolvency protections – what’s the real problem?

09/09/2020

insolvent trading zombie companies COVID-19 liquidation

The Australian government has extended the monetary threshold of A$20,000 for the commencement by creditors of bankruptcy and liquidation proceedings ...

Review of Australia’s insolvency safe harbour – s 588GA

03/02/2020

insolvent trading NZ safe harbour General

Australia’s ‘safe harbour’ regime under s 588GA is due for review, since September 2019, as to whether it offers the ...

Traill insolvency conference 1-2 May – the ILRA changes – pre-sale closes tomorrow – 31 March

29/03/2017

insolvent trading ipso facto Traill Conferences and events

For those registered at Rosie Traill’s excellent annual conference, and those who register by the early bird deadline tomorrow, Friday 31 ...

Mad Dogs could not legally perform its contract in breach of insolvent trading laws

20/11/2016

insolvent trading 588G Case law

An insolvent company cannot legally continue to perform its contract by which debts are incurred. Hence it has no claim ...

Categories

Main Menu