Search results

Coronavirus safe harbour – beware the claytons waterfall in s 588GAAA

30/09/2020

It is interesting to now see the clear limitations the government has placed on the protections offered by the COVID-19 ...

Review of Australia’s insolvency safe harbour – s 588GA

03/02/2020

insolvent trading NZ safe harbour General

Australia’s ‘safe harbour’ regime under s 588GA is due for review, since September 2019, as to whether it offers the ...

Coercive control and insolvency

01/10/2024

ASIC insolvent trading coercive control

ASIC has asked registered liquidators to “stay alert” for signs of family and domestic violence when conducting insolvency administrations.[1] ASIC ...

New corporate definitions of director, officer and asset

01/02/2024

ALRC Corporations Act director property

Following the ALRC’s work on Ch 7 of the Corporations Act, attention has already been given to legislative changes tidying ...

Insolvent trading in context

Insolvent trading is one of the many items for review recommended by the Parliamentary Joint Committee report on Corporate Insolvency. ...

Insolvent Trading and Minimal Returns to Creditors in Liquidations

05/10/2023

insolvent trading deterrence

This is a brief response to a well-researched and thoughtful article by Associate Professor Mark Wellard – Insolvent Trading: Director ...

NZ Supreme Court confirms Mainzeal directors’ liabilities for over NZ$39 million

25/08/2023

insolvent trading NZ

The Supreme Court of New Zealand has dismissed directors’ appeals from a finding that they must pay over NZ$6 million ...

UK’s review of its 2020 insolvency law reforms, with Australia compared

09/07/2023

Insolvency Service UK monitors - UK CIGA - UK

The quality of a recent UK review of its 2020 insolvency law reforms is compared with the approach taken in ...

Insolvency law ministers – personal, corporate, Indigenous, cross-border, employment and more

18/08/2022

Ministers

Relevant federal ministers whose portfolios involve insolvency law are primarily Mr Mark Dreyfuss QC as Attorney-General, Dr Jim Chalmers as ...

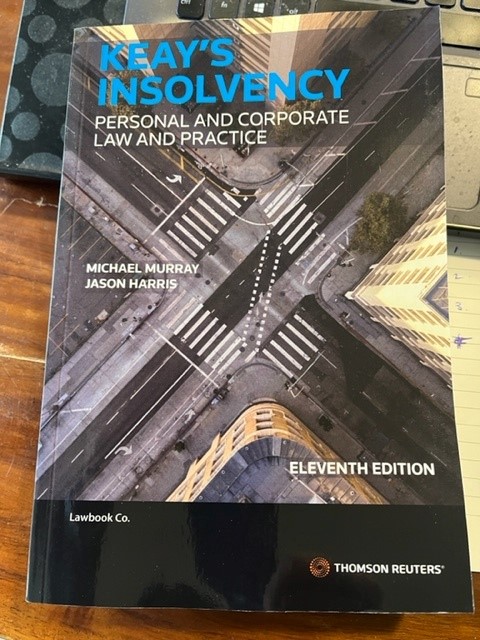

Keay’s Insolvency – Personal and Corporate Law and Practice, 11th ed, 2022

03/08/2022

We are pleased to have published the 11th edition of our textbook, Keay’s Insolvency – Personal and Corporate Law and ...

Australia’s safe harbour protection from insolvent trading liability, continued

05/04/2022

insolvent trading safe harbour

The report on Australia’s safe harbour protection for directors (s 588GA) from what is said to be our strict insolvent ...

Corporate Collective Investment Vehicles

27/09/2021

managed investment schemes CCIV

The government is consulting on a Bill in line with what it says is its commitment “to establishing a commercially viable ...

Australia’s review of its insolvency safe harbour – more than a few issues to consider, but in the end, about not much

06/09/2021

insolvent trading safe harbour

The terms of reference and what is called a ‘discussion paper’[1] for this review under s 588HA have been released, ...

Review of Australia’s safe harbour protection from insolvent trading – remember s 588HA [updated]

23/08/2021

insolvent trading safe harbour

The federal government has finally made arrangements to have Australia’s “safe harbour” from insolvent trading law reviewed – s 588GA, ...

Insolvent trading convictions set aside on mental health grounds

16/06/2021

Crime insolvent trading

Following convictions and imprisonment for insolvent trading arising from the 2009 collapse of Kleenmaid, its founder, Andrew Young, has succeeded ...

An insolvency safe harbour based on culture and tradition?

04/05/2021

insolvent trading CATSI Act

For years Australia had no ‘safe harbour’ protection for directors from insolvent trading. In 2017, one was introduced, then three ...

Review of the English Insolvency Rules 2016

13/03/2021

Insolvency Service UK UK rules review 2021

The 2016 insolvency rules of England and Wales are being reviewed, in accord with a statutory requirement to do so ...

Australia’s new liquidator registration processes, and its ‘new liquidators’

On 30 December 2020, ASIC issued guidance on the new liquidator registration processes that apply in Australia two days hence ...

Is Australia’s insolvency safe harbour protection working – who knows?

30/10/2020

insolvent trading safe harbour Articles

The 2 year review of Australia’s safe harbour protection for directors, due from the government over a year ago, never ...

Choosing practitioners to administer Australian MSME insolvencies

15/10/2020

NZ safe harbour UK artificial intelligence

The Australian government is presently finalising its draft SME insolvency law reform proposals. Apart from getting the law right, as ...

“industry codes with their precepts, guidance and aspirational verbiage cannot dictate the proper construction and application of the relevant statutory provisions”

30/09/2020

ARITA Code DIRRI Articles

Soft law in Australia takes a rather strict approach in assessing the independence of insolvency practitioners, more so than, for ...

Duties of directors of insolvent companies – New Zealand Supreme Court decision

29/09/2020

articles directors duties insolvent trading NZ

The NZ Supreme Court has given a significant decision on the duties of directors in the face of their company’s ...

Fightback! SMEs get a new restructuring tool

The federal Treasurer has announced a new restructuring regime for struggling small to medium enterprises (SMEs)[1] which adopts a ‘debtor-in-possession’ ...

Extension of the COVID-19 insolvency protections – what’s the real problem?

09/09/2020

bankruptcy insolvent trading zombie companies COVID-19

The Australian government has extended the monetary threshold of A$20,000 for the commencement by creditors of bankruptcy and liquidation proceedings ...

Categories

Main Menu