Search results

New Zealand – corporate insolvency practitioner regulation

19/11/2019

NZ regulation UK coregulation

The New Zealand government has called for submissions on the proposed minimum standards and conditions for the licensing of insolvency

New Zealand insolvency reform – half a gift card

10/11/2019

gift cards NZ General Articles

The New Zealand government has decided to give consumers with unclaimed gift cards issued by a failed business a priority

New Zealand insolvency practitioner reforms

Submissions on proposed major changes to NZ insolvency laws through the Insolvency Practitioners Bill, presently before parliament, closed on 24

New Zealand’s changes to its insolvency laws

11/07/2018

New Zealand regulation General Articles

Proposed changes to NZ insolvency laws through the Insolvency Practitioners Bill, presently before parliament, are open for submissions until 24

Insolvency practitioner regulation – New Zealand & Australia

28/08/2017

New Zealand

Comparing NZ insolvency law with Australia’s, in preparation for the BFSLA conference this week on 1 September 2017, the day

A New Zealand Ponzi – the final outcome of McIntosh v Fisk

29/05/2017

Case law Insolvency Law Reform Law reform New Zealand

The second report of the NZ insolvency working group had deferred consideration of the application of the voidable transactions regime

Challenges to trusts by bankruptcy trustees – New Zealand law reform

15/05/2017

Books, articles, commentary Case law New Zealand sham

A recent change to the New Zealand Insolvency Act 2006 (Schedule 1, new para (x)) has given power to the

New Zealand Voluntary Administration Law – an independence challenge to the administrators

12/10/2016

Case law independence New Zealand NZ

“Pre-appointment work, including involvement in the drafting of a proposed deed of company arrangement, is not unusual in the corporate

New Zealand – the outlier of international insolvency regulation

31/08/2016

AFSA articles ASIC commentary

Australia and other countries will be relieved that New Zealand is again looking at licensing and regulating its insolvency practitioners.

ASIC’s review of offence reporting – RG 16

13/04/2024

PJC Insolvency Inquiry 2022 investigations

My 2019 article – Offence reporting by insolvency practitioners (2019) 20(4&5) INSLB 88 was written at a time of “ongoing

“Thousands and thousands of pounds have been lost …”

09/04/2024

industry bodies IP regulation insurance

The regulation of insolvency practitioners (IPs) might come in for scrutiny in light of two current matters involving apparent missing

Corporations Act redrafting – ch 5?

23/01/2024

OPC ALRC 141 Corporations Act

Some years ago, I suggested to a Treasury officer that Ch 5 of the Corporations Act be redrafted and simplified.

NZ insolvency practitioner sanctioned

01/12/2023

co-regulation NZICA New Zealand insolvency

A sanction of a New Zealand liquidator for the poor handling of his matters provides an illustration of New Zealand’s

Insolvent trading in context

Insolvent trading is one of the many items for review recommended by the Parliamentary Joint Committee report on Corporate Insolvency.

Regulation of firms offering insolvency services

17/10/2023

co-regulation single insolvency regulator firms

Further to my earlier post on insolvency practitioner (IP) regulation in the UK, and contrary to expectations,[1] the UK government

‘Masculinity contest cultures’, and gender imbalance?

14/10/2023

gender PJC Insolvency Inquiry 2022 firms

Evidence before the Parliamentary Joint Committee inquiry into Ethics and Professional Accountability [1] (PJC inquiry) may assist in considering the

Voluntary administrators removed as NZ interim liquidators of debtor on independence grounds

14/10/2023

independence

Following the appointment by the New Zealand High Court of Australian voluntary administrators of Probis as New Zealand interim liquidators

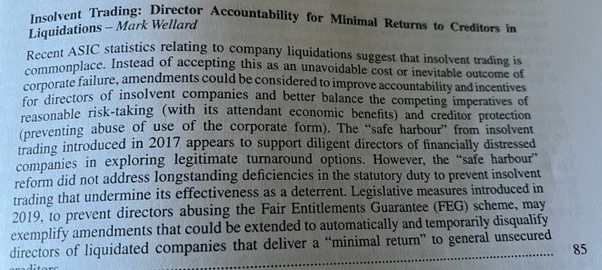

Insolvent Trading and Minimal Returns to Creditors in Liquidations

05/10/2023

insolvent trading deterrence

This is a brief response to a well-researched and thoughtful article by Associate Professor Mark Wellard – Insolvent Trading: Director

The cross-border regulation of insolvency practitioners – insights from INSOL Tokyo

26/09/2023

Cross-border insolvency practitioner regulation

I was invited to present at the INSOL International Academic Colloquium on 12 September 2023 in Tokyo on the panel

Cross-border regulation of insolvency practitioners – INSOL Tokyo – where are the government regulators?

This commentary has now been updated. See The cross-border regulation of insolvency practitioners – Murrays Legal ============================================== I was pleased

NZ Supreme Court confirms Mainzeal directors’ liabilities for over NZ$39 million

25/08/2023

insolvent trading NZ

The Supreme Court of New Zealand has dismissed directors’ appeals from a finding that they must pay over NZ$6 million

UK insolvency practitioners to come under direct government regulation

17/07/2023

co-regulation UK IP regulation PJC Insolvency Inquiry 2022

At the same time that the chair of the Australian PJC inquiry into corporate insolvency, Senator Deborah O’Neill, said that

Gender, and diversity, in insolvency practice, continued

The July 2023 PJC report into corporate insolvency[1] makes recommendations on the “problem” of the limited female representation among liquidators,

Should the firms of insolvency practitioners be regulated, along with the practitioner?

While Australia is currently focusing on the standards of conduct of accounting firms, and their partners – see Ethics and

Categories

Main Menu