Law reform

Corporations Amendment (Corporate Insolvency Reforms) Act 2020 No 130 of 2020

This is now law, with a date of assent of 15 December 2020, and with a commencement date for most ...

Bankruptcy threshold to be increased from $5,000 to $10,000

18/12/2020

bankruptcy threshold Articles

The Australian government has not been ignoring personal insolvency reform in 2020, despite its recent small business reforms dealing only ...

NZ’s measured review of class actions and litigation funding, noting Australia’s ‘polarised’ debate

17/12/2020

ALRC class actions litigation funding NZ

The New Zealand Law Commission has commenced a 2 year inquiry into litigation funding and class actions, right at the ...

Does small business count?

15/12/2020

ASBFEO bankruptcy MSME Articles

This Ombudsman’s follow up report – Small Business Counts – examines small to medium business enterprises (SMEs) from an economics ...

Australia’s corporate SME insolvency law may soon become law – and then….

The Corporations Amendment (Corporate Insolvency Reforms) Bill 2020 progressed through a third reading in the Australian parliament on 8 December ...

Corporate insolvency reforms 2020 – referred to a committee?

Report No 11 of 2020 of the Senate’s selection of bills committee of 3 December 2020 has considered the Corporations ...

Bankruptcy seems to be the hardest word

29/11/2020

bankruptcy COVID-19 insolvency Articles

The government has not said anything about insolvency law reform for financially struggling individual small business operators among its claimed ...

SME insolvency – an alternative approach

24/11/2020

Articles

Small business enterprises (SME) in Australia are conducted through the full range of legal entities available – sole traders, partners, ...

Australia’s small business restructuring practitioners

19/11/2020

articles MSME regulation COVID-19

Australia is proposing a sub-group of liquidator accountants to assist in administering its new corporate SME insolvency laws, set to ...

Where’s personal insolvency nowadays? Australian parliamentary confusion

05/11/2020

Attorney-General Treasury silos Articles

This rather painful transcript of Senate estimates hearing on 27 October 2020 illustrates many things but in particular how small ...

Singapore’s new small business restructuring and liquidation regime – a “move away from earlier efforts to ‘hold the line'”

The Singapore parliament passed the Insolvency, Restructuring and Dissolution (Amendment) Bill 2020 on 3 November 2020. It will amend the ...

Do the Australian small to medium business insolvency reforms add up?

The numbers upon which the government is relying for the proposed SME reforms[1] don’t seem to add up. Apart from ...

ATO’s right to garnishee – a “privileged position … likely to result in failed corporate rescue attempts”?

27/10/2020

ATO MSME garnishee notices Books and journals

A recent article Getting the priorities right: ATO garnishee notices in times of corporate distress by Sylvia Villios and David ...

Transparency in the selection process of liquidators and trustees

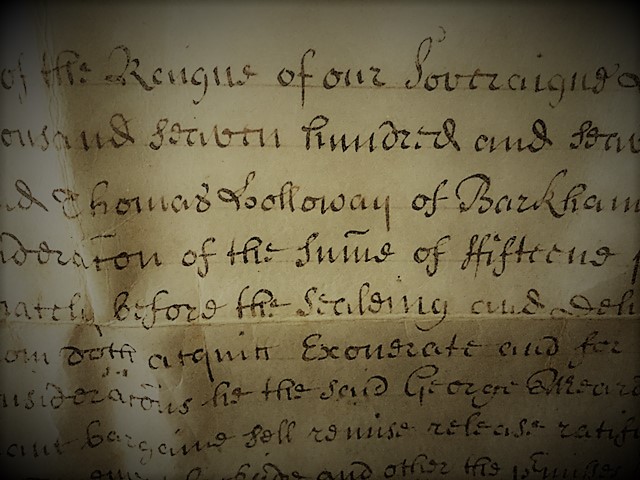

The Insolvency Law Reform Act 2016 introduced some, let’s say, novel provisions in relation to the registration and discipline of ...

‘In the ordinary course of business’ in insolvency – why are we following wrong thinking New Zealanders?

15/10/2020

NZ ordinary course of business Articles

The term ‘ordinary course of business’ in law is meant to describe a transaction that was within the normal operations ...

Choosing practitioners to administer Australian MSME insolvencies

15/10/2020

NZ safe harbour UK artificial intelligence

The Australian government is presently finalising its draft SME insolvency law reform proposals. Apart from getting the law right, as ...

Who wants to be an SME insolvency practitioner? Australia’s proposed reforms

Australia proposes to follow England’s lead in giving insolvency practitioners the initial role in new debtor in possession insolvency reforms, ...

Australia’s proposed MSME insolvency reforms – an international perspective

Australia’s draft legislation to implement its announced MSME corporate insolvency reforms may have drawn more on international than local thinking, ...

Fightback! SMEs get a new restructuring tool

The federal Treasurer has announced a new restructuring regime for struggling small to medium enterprises (SMEs)[1] which adopts a ‘debtor-in-possession’ ...

Insolvency protections extension to 31 December 2020

The Corporations and Bankruptcy Legislation Amendment (Extending Temporary Relief for Financially Distressed Businesses and Individuals) Regulations 2020 serve to extend ...

UK gearing up for major corporate liquidations in ‘unpredictable times for the insolvency sector …’

In what appears to be ominous but necessary preparation for the continued economic consequences of COVID-19, the UK Insolvency Service ...

Insolvency and debtor in possession – hospital or home care?

If Joe thought he might have a serious medical condition, but did not want to go to hospital for a ...

Bankrupt for life?

An Australian personal bankruptcy lasts for a minimum of 3 years in Australia – whether it is an overly committed ...

Can a debtor resist a bankruptcy arising from COVID-19?

14/08/2020

UK COVID-19 creditor petitions Articles

So far the courts in Australia have not had to deal with many creditors’ bankruptcy petitions against debtors in the ...

Categories

Main Menu