Books and journals

How low can we go – funding the insolvencies of assetless estates

Obvious as it is to say, insolvency involves limited or no money, and how to fund its existence as a

The Law of Bankruptcy Notices and Creditors’ Petitions, by Nicholas J Simpson, 2020 – a book review

22/12/2020

book review Books and journals Articles

This is a very good and topical Australian text, adequately and accurately described by its title. My review of it

Reinventing Bankruptcy Law – Virginia Torrie

21/12/2020

book review Books and journals Articles US/Canada

This is a very good book on Canadian insolvency law, sadly with no equivalent in Australia, as I explain below.

ATO’s right to garnishee – a “privileged position … likely to result in failed corporate rescue attempts”?

27/10/2020

ATO MSME garnishee notices Books and journals

A recent article Getting the priorities right: ATO garnishee notices in times of corporate distress by Sylvia Villios and David

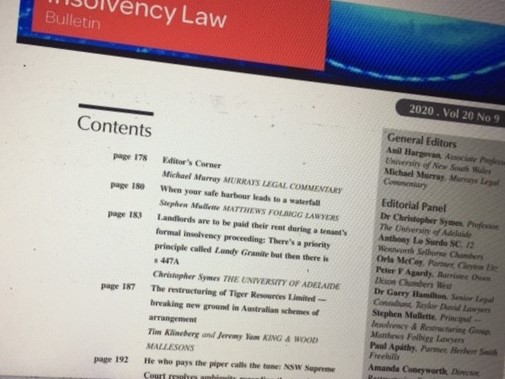

Insolvency Law Bulletin – safe harbour, Tiger Resources, Virgin and who’s the employer

10/09/2020

Insolvency Law Bulletin General Books and journals

The latest Insolvency Law Bulletin contains a warning about the (then) ending on 24 September of the COVID-19 protections, now

How is Australia’s safe harbour from insolvent trading working? some survey results

21/06/2020

588G safe harbour TMA Australia 588GA

An article by Professor Ian Ramsay and Associate Professor Stacey Steele has just been published reporting on survey responses of

Insolvency Law Bulletin – June 2020

11/06/2020

Insolvency Law Bulletin NZ Books and journals Articles

The latest issue of the Insolvency Law Bulletin has just appeared containing a wide range of topics in personal and

Feminist input to the theories of insolvency?

14/05/2020

articles feminism insolvency theory Books and journals

For those who would like to see how it is said that ‘feminist ideals’ are met in one or other

UNCITRAL guidance on MSE insolvency – Insolvency Law Bulletin article

18/04/2020

Insolvency Law Bulletin MSE General Books and journals

An article in the latest Insolvency Law Bulletin[1] reports on the progress of UNCITRAL Working Group V[2] in developing law

The proposed reinvigoration of the UK’s business rescue culture through ‘recalibration of the balance of power’ – some steps too far for Australia?

01/03/2020

debtor in possession regulation UK UK restructuring

A recent academic article from the UK has reviewed proposed restructuring reforms announced by the government in August 2018, although

A not so simple fix for franchise insolvency?

22/02/2020

franchises General Books and journals Articles

The financial collapse of a franchisor can have a severe impact on its franchisees but a “simple fix” proposed to

Three year ‘imprisonment’ for bankruptcy debt

Australia has historically been seen as severe in its approach to unpaid debt and opposition to changing the 3 year

Insolvency R&B law reform ideas

01/01/2020

ASIC fees government liquidator UK abandoned companies

While the ASBFE Ombudsman, ARITA and others are looking at insolvency law reform, including for SMEs, they will no doubt

Halifax – a cross-border insolvency

15/12/2019

NZ letter of request General Books and journals

A joint hearing of Australian and New Zealand courts is one way to deal with an intermingled cross-Tasman insolvency, through

Insolvency Law Bulletin – penalties, phoenix & preferences, franchises & offence reports

30/11/2019

ALRC Cross-border insolvency offence reporting penalties

The latest issue of the Insolvency Law Bulletin (2019) 20(4&5) covers some very topical issues. The Halifax Investment Services matter

The evolution of bankruptcy and insolvency laws and the case of the deed of company arrangement

05/10/2019

holding DOCA UK General Books and journals

This is a thoughtful and instructive article on the process of the historical development of the bankruptcy and insolvency laws

Digital disruption is here but “progress towards a digital insolvency practice has to date been slow”

A recent journal article on the impact of artificial intelligence and its use by the insolvency profession has good and

‘A good idea’ – assignment of a liquidator’s recovery rights

18/09/2019

UK assigment of claims Books and journals Articles

A liquidator has transferred, with court approval, potential recovery claims to the ATO, as the major and only creditor in

A bankrupt’s list of ‘personal’ assets

26/05/2019

Books and journals

The law requires those people in bankruptcy to record their assets and liabilities in a ‘statement of affairs’. It is

Keay’s Insolvency – note from the authors – progressive updates since publication

24/02/2019

General Books and journals Blog

As the authors of Keay’s, and in order to assist readers, we propose to make brief reference to law changes

Law reform obituary – CAMAC 1983-2018

28/10/2018

articles CAMAC General Books and journals

The Corporations and Markets Advisory Committee (CAMAC) was a corporate law reform body comprising individuals eminent in that field. It

Keay’s Insolvency – a law reform launch

27/08/2018

Keay's Insolvency General Books and journals Articles

The recent launch of the new 10th edition of Keay’s Insolvency prompted some pointed comments about the current insolvency system

Friendly and ‘friendly’

20/05/2017

articles ASIC commentary Fair Entitlements Guarantee - FEG

With the rather confusing term ‘friendly liquidator’ continuing to be used: by the media: Dirty Deeds: Inside Australia’s Biggest Tax

Categories

Main Menu