ARITA

Principles of Regulation of Insolvency Practitioners – an international standard

This comment was issued in October 2018; it is re-issued in May 2023, but not updated, for interest. The rather

Reprimand and more for a liquidator – that’s about as much as we know

By a media release ASIC has reported that a disciplinary committee has decided to reprimand a liquidator, Nicholas Crouch, under

Insolvency practitioner [over]-regulation in Australia – an update

While the UK is reviewing its insolvency practitioner (IP) co-regulation system, Australia’s direct regulation, with minimal but expansive co-regulation, might

Licensing of insolvency practitioners – decision making principles from New Zealand [updated post 13 June 2021]

13/06/2021

Administrative law ARITA NZ RITANZ

Mr Damien Grant, the New Zealand insolvency practitioner who successfully challenged RITANZ’s decision to deny him the right to practice

Double suspension as a liquidator and as a trustee

25/02/2021

ARITA New Zealand discipline

An experienced Australian insolvency practitioner (IP) has had his right to practise as a liquidator suspended by a Court for

ARITA’s response to the Ombudsman’s small business insolvency inquiry

ARITA has offered a 60-page submission to the Ombudsman’s inquiry, which, given the quality of the inquiry, may be rather

A liquidator disciplinary decision – some regulatory insights

24/01/2020

AAT ARITA Registration and discipline processes regulation

A decision of a tribunal in Australia gives some insight into the insolvency practitioner discipline processes introduced in 2017, which

Insolvency developments in the 2018-19 annual reports – ASIC, AFSA, AGD and ATO

Annual reports nowadays are more marketing publications as to various achievements of the relevant agencies and their compliance with statutory

Revised insolvency standard for practitioners. As to their professional bodies …

25/06/2019

APESB ARITA New Zealand regulation

The Accounting Ethical and Professional Standards Board (APESB) has approved a new and revised APES 330 – Insolvency Services, the

Treasury Laws Amendment (Measures for a later sitting) Bill 2018: Miscellaneous amendments

06/11/2018

AFSA ARITA ASIC electronic service

The law reform process of going through a piece of legislation and picking up minor errors is useful and necessary

Mis’conduct proceedings based on evidence reported in the media’

ARITA advises that it can now ‘begin conduct proceedings [against its members] based on evidence reported in the media’. Murrays

Insolvency remuneration – time-charging, or better?

25/10/2018

ARITA Jackson Quick remuneration

Lawyers’ fees in class actions were the subject of a recent conference[1] paper by Sir Rupert Jackson, given in Melbourne,

Voluntary administrations and the benefits, or otherwise, of board turnover

23/10/2018

ARITA CAMAC debtor in possession US Ch 11

Research just published[1] has looked at the relation between board turnover and the likelihood that a company that enters a

ASIC’s 2018 annual report – insolvency, what to expect

07/10/2018

ARITA industry bodies industry notices General

An interesting aspect of ASIC’s forthcoming 2018 annual report will be its review of the operation of the changes brought

New Zealand insolvency practitioner reforms

Submissions on proposed major changes to NZ insolvency laws through the Insolvency Practitioners Bill, presently before parliament, closed on 24

What’s up, or on, in insolvency, early in 2018?

18/01/2018

General gift cards Insolvency profession international

The following commentary on submissions due, events and conferences, professional standards, international and local, hearings and case law*, all in

Pending insolvency law and practice changes

18/12/2017

Law reform safe harbour UK insolvency AFSA

Some of us are waiting for Santa, others are waiting on anticipated updates in insolvency law so we can send

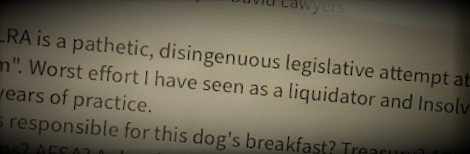

Insolvency Law Reform Act – some real legislation errors

06/09/2017

AFSA ARITA ASIC dog's breakfast

woodfer The changes effected by the Insolvency Law Reform Act 2016 are now law with some parts having commenced on

ABA’s Anna Bligh and bank lending reforms

Anna Bligh, the Chief Executive of the Australian Bankers Association, has recently spoken of the “strong and mutually beneficial relationship between

Whistleblowing, as a means of professional regulation?

The use of whistleblowers in the regulation of tax and corporate law, and the bases for incentivizing and protecting them, are

INSOL Academics 2017

The INSOL Academics Colloquium was held over the weekend of 18-19 March 2017 in Sydney. The session covered a wide

New insolvency laws commencing 1 March – Q&A

28/02/2017

ad hoc committee AFSA ARITA ASIC

This series of questions and answers address many of the issues with which practitioners and lawyers will be confronted in

Umpteen professional bodies regulating insolvency practitioners – overkill? or a spreading of the risk?

08/01/2017

ad hoc committee AFSA ARITA ASIC

The new regulatory regime of insolvency practitioners under the Insolvency Law Reform Act 2016 provides for co-regulation shared between the regulators –

An expansion of the Banking Code, or is a change in the law needed?

The story about the conduct of bank officers in the Sydney Insolvency News prompts my suggestion for a widening of

Categories

Main Menu