UK insolvency

UK insolvency review – “better outcomes from insolvency and increased returns to creditors”?

20/04/2022

INSOL International UK insolvency

The first and rather glowing report on the operation of the Insolvency (England and Wales) Rules 2016 has been issued ...

Revised insolvency standard for practitioners. As to their professional bodies …

25/06/2019

APESB ARITA New Zealand regulation

The Accounting Ethical and Professional Standards Board (APESB) has approved a new and revised APES 330 – Insolvency Services, the ...

ASIC’s new insolvency ‘ROCAP’ – the Report On Company Activities and Property

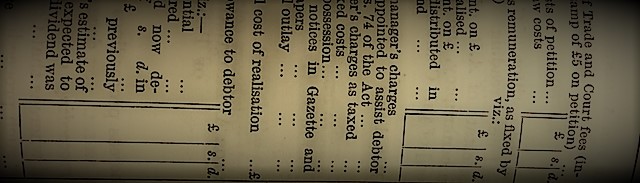

The long history of the report as to affairs in corporate insolvency – the RATA – which started about 1890, ...

What’s up, or on, in insolvency, early in 2018?

18/01/2018

Insolvency profession international Law reform MSME

The following commentary on submissions due, events and conferences, professional standards, international and local, hearings and case law*, all in ...

Pending insolvency law and practice changes

18/12/2017

UK insolvency AFSA APESB ARITA

Some of us are waiting for Santa, others are waiting on anticipated updates in insolvency law so we can send ...

Insolvency practitioner independence – a ‘fair-minded’ or ‘uncharitably-minded’ assessment

28/10/2017

APESB Case law General independence

The most recent decision on insolvency practitioner independence confirms an ongoing trend of treating the fair-minded observer, whose view is ...

International insolvency regulation – London 2017

The annual meeting of the International Association of Insolvency Regulators, IAIR, is being held in London, from 4 to 7 ...

INSOL’s Directors in the Twilght Zone – Australia’s “medium risk” for its directors

INSOL International has released the 5th edition of its excellent review of the international laws regulating director conduct in the ‘twilight ...

How fixed fees work in insolvency – 1,796 companies at £6000 each = £1600 per company

28/04/2017

AFSA ASIC Books, articles, commentary Case law

An English Chancery Court decision has given guidance on the reasonableness of fixed fees in an insolvency, albeit the fees ...

UK insolvency practitioners can F…. their Forms

25/02/2017

Books, articles, commentary forms Law reform UK insolvency

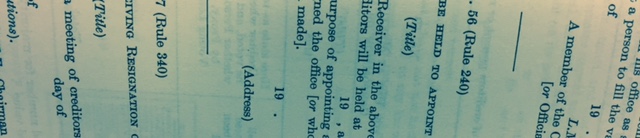

While insolvency practitioners in Australia are anxiously waiting to find out what new forms they must fill in and tick ...

Umpteen professional bodies regulating insolvency practitioners – overkill? or a spreading of the risk?

08/01/2017

ad hoc committee AFSA ARITA ASIC

The new regulatory regime of insolvency practitioners under the Insolvency Law Reform Act 2016 provides for co-regulation shared between the regulators – ...

Another new co-regulation regime for insolvency practitioners – NZ, following the UK and India

Just as India has introduced co-regulation of its new breed of insolvency practitioners, so has New Zealand acted on a ...

More (and more) government inquiries

31/10/2016

APRA ASIC Books, articles, commentary Insolvency Law Reform

Two important Senate inquiries of 2014 and 2015 that lapsed at the election have been reinstated, but still with long ...

Our insolvency law reform – will it all end in tears?

01/06/2016

debtor in possession Ireland Law reform UK insolvency

While Australia has been debating for too long what law we should have to assist in the recovery of distressed businesses, both ...

Categories

Main Menu