international

TIP – The Insolvency Portal

27/11/2022

Finland forms General Insolvency profession

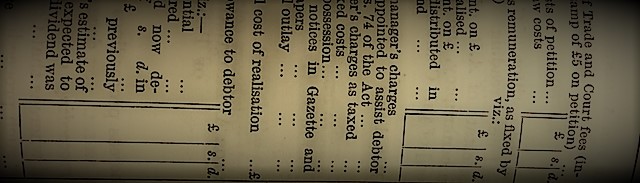

My 2022 versions of the Bankruptcy Act and the Corporations Act retain much of the process and procedure found in ...

UK consultation on insolvency recovery and governance reforms

21/03/2018

advisers General Insolvency Service UK international

The UK government is consulting on law reform with a view to, in its words, “to improve the UK’s corporate ...

Some casual Friday comments on recent insolvency developments

02/03/2018

AASB Accountants AFSA APESB

This is a quick review of some on-going current issues in insolvency and related. Pending decisions The Commonwealth v Byrnes ...

Lawless, oxymoronic insolvency law – the mining regulators aren’t happy.

This comment updates our recent commentary on the complicated intersection between insolvency law and environmental regulation. There are now at ...

Cleaning up after a failed miner – who pays: Part 2

This commentary highlights a confluence of 4 events concerning the complicated intersection between insolvency law and environmental regulation, one event ...

The wider context of the proposed one-year period of bankruptcy

06/02/2018

AFSA bankruptcy Economics European Commission

Many less than 1% of bankrupts warrant an objection to discharge from their bankruptcy, trustees leave it til the last ...

ASIC and one-year bankruptcy, AUSTRAC, a fees claim settled, and more …

03/02/2018

ASIC AUSTRAC Case law Conferences and events

The following further commentary on insolvency – submissions due, events and conferences and case law – may be of interest. ...

What’s up, or on, in insolvency, early in 2018?

18/01/2018

MSME New Zealand APESB NOCLAR

The following commentary on submissions due, events and conferences, professional standards, international and local, hearings and case law*, all in ...

Cleaning up after a failed miner – who pays?

28/12/2017

Canada Case law chain of responsibility environmental

The Queensland Court of Appeal in Linc Energy, and the Supreme Court of Canada in Redwater Energy, are each determining ...

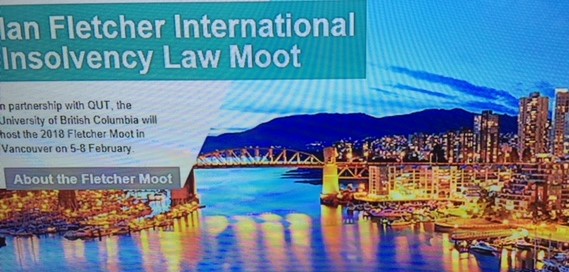

Vancouver 2018 – insolvency moots and conference – QUT and UBC

08/12/2017

Canada Conferences and events General international

Following the success of the first Ian Fletcher International Insolvency Law Moot, held in Sydney in March 2017, the QUT ...

50 years of UNCITRAL – and recollections from Bob Ellicott

At a lecture celebrating the 50th anniversary of UNCITRAL – the United Nations Commission on International Trade Law – a ...

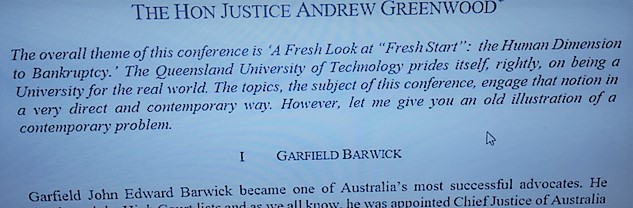

QUT Law Review – a special issue on personal insolvency

Australia’s current major bankruptcy law reforms are necessarily informed by a range of academic and professional input, from here and ...

Safe harbour for directors of corporate groups? An UNCITRAL initiative

09/11/2017

General international Law reform safe harbour

UNCITRAL’s Insolvency Working Group V is meeting in Vienna next month to discuss the preparation of guidance for directors ...

‘The International Court of Justice as a Working Court’ – Judge James Crawford

02/09/2017

Australian Academy of Law Conferences and events international International Court of Justice

On 25 September 2017, the annual “Patron’s Address” of the Australian Academy of Law is being given by his Excellency ...

OECD report – “low personal costs to entrepreneurial failure with high barriers to restructuring”

26/07/2017

Books, articles, commentary Economics international

Economic analyses of insolvency in Australia are strangely limited, given that a major purpose of an insolvency regime is its support of ...

A safe harbour from our harsh insolvency laws?!

15/06/2017

articles commentary Insolvency Law Reform international

The “safe harbour” reform bill has been introduced into federal parliament to address directors’ “medium risk” of liability for insolvent trading. ...

APES 110 – accountants, whistleblowers and safe harbour advisers to note

Increased professional obligations of accountants, and insolvency practitioners, to refer breaches of the law to the authorities, are being considered at ...

INSOL’s Directors in the Twilght Zone – Australia’s “medium risk” for its directors

INSOL International has released the 5th edition of its excellent review of the international laws regulating director conduct in the ‘twilight ...

World Bank Report on the Treatment of MSME Insolvencies

12/05/2017

international Law reform MSME World Bank

The World Bank has just released a report on small business insolvencies – Report on the Treatment of MSME Insolvency, ...

INSOL’s Statement of Principles for a Global Approach to Multi-Creditor Workouts

INSOL International has issued a second and updated edition of its Statement of Principles for a Global Approach to Multi-Creditor ...

Gift-cards resurrected

04/05/2017

articles commentary gift cards international

The 2016 “gift-card” report of the UK Law Commission examined whether there should be greater protection for consumers who lose ...

Appointing and Remunerating Insolvency Practitioners in Japan: The Roles of Japanese Courts

This excellent review of insolvency practice in Japan provides an instructive perspective for those of us from Western legal traditions, ...

How fixed fees work in insolvency – 1,796 companies at £6000 each = £1600 per company

28/04/2017

AFSA ASIC Books, articles, commentary Case law

An English Chancery Court decision has given guidance on the reasonableness of fixed fees in an insolvency, albeit the fees ...

INSOL International – Special Report on Insolvency Practitioners’ Remuneration

INSOL International has just published a global review of how insolvency practitioners’ fees are assessed and approved across a range of jurisdictions, ...

Categories

Main Menu