The long history of the report as to affairs in corporate insolvency – the RATA – which started about 1890, has now ended, in 2018.

ASIC has replaced the RATA with a ROCAP – Report On Company Activities and Property – which must be prepared and lodged with ASIC by directors of a company that goes into liquidation or other type of insolvency process.

As to 1890, a major report on the inadequacies of the RATA by former liquidator Peter Keenan – An appraisal of the report as to affairs, of March 2012 – noted that

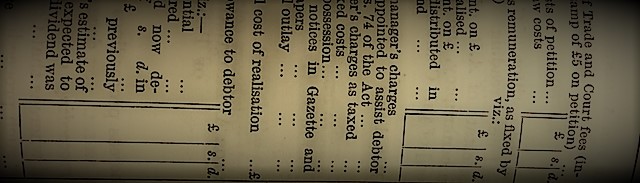

‘in all fundamental respects today’s RATA form is the same as the Statement of Affairs was when the Uniform Companies Acts were passed in 1961. … In fact, it appears that the form has remained almost the same since the 1890s’.[1]

Keenan’s report involved an extensive survey of members of the insolvency profession, with one major response being that the questionnaire type approach in bankruptcy should be adopted in corporate insolvency.

His report recommended that ASIC undertake a redesign of the RATA in light of his detailed findings.

ASIC did so and the outcome is the release by ASIC in October 2018 of what is describes as a Hot Topic – Revised RATA.

The ROCAP, and its merits

ASIC says[2] the new 37 page form reflects “‘best practice’ forms design and use of behavioural design tools to ensure” insolvency practitioners (IPs) receive better information to help them do their job.[3] It claims that the revised form allows IPs to obtain better information about events leading up to their insolvency appointment, which will be useful and relevant to IP’s investigations, asset recoveries, and reporting to creditors and to ASIC.

It also aims to reduce costs by reducing the time that IPs ‘spend dealing with multiple forms and letters (such as a separate director’s questionnaire)’ to gather information from directors about their insolvent company. It is said that directors now have a form that ‘testing shows best facilitates them completing it’, reducing time spent following up information the directors did not initially provide, and reducing requests from liquidators under ASIC’s Liquidator Assistance Program.

ASIC says it has shared the new form with AFSA for its review of its bankruptcy statement of affairs.

Comparisons

The 37 page ROCAP compares with:

- the 14 page statement of affairs used in the UK (including 6 pages of guidance);

- New Zealand’s 15 page statement of affairs; and

- AFSA’s 25 page statement of affairs in bankruptcy.

Feedback?

ASIC intends releasing the ROCAP soon, in November 2018. There is no call by ASIC for comment or feedback on the ROCAP, which must mean that the profession’s views have been taken into account, as well as those of credit manager, banks, insolvency lawyers and corporate advisers. In particular, the courts will have given their view, given the continued need to file the ROCAP with the court,[4] and the fact that the courts will be enforcing compliance.

No doubt ASIC would welcome feedback in any event.

[1] See also The report as to affairs – an appraisal (2012) 24(2) A Insol J 10, P Keenan; see also IPAA ‘President’s Notes’, p 4.

[2] ASIC Corporate Insolvency Update – Issue 9, October 2018

[3] ASIC’s behavioural focus goes back some years: see How directors of insolvent companies [should] behave – an ASIC view, ARITA, 28 June 2014.

[4] Corporations Act, s 475(7)