Search results

Insolvent assetless MSMEs – all but forgotten?

14/12/2022

regulation technology assetless companies deregistration

My commentary of October 2020 is re-issued, for readers’ interest. Does it matter that a company is insolvent such that ...

TIP – The Insolvency Portal

27/11/2022

forms General Insolvency profession international

My 2022 versions of the Bankruptcy Act and the Corporations Act retain much of the process and procedure found in ...

PJC insolvency inquiry – deregistered companies submission

16/11/2022

PJC Insolvency Inquiry 2022 assetless companies

An early submission to the Parliamentary Joint Committee inquiry into corporate insolvency from Mr Russell Morgan, liquidator, of 15 November ...

A productive insolvency regime – who knows?

15/11/2022

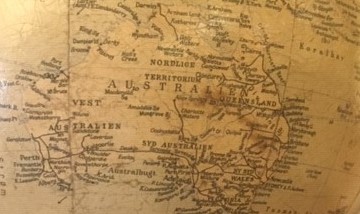

In the various calls for a holistic review of Australian insolvency law, there is little explanation of what exactly needs ...

Australia’s review of its corporate insolvency laws – updated

The hearing in relation to the law of set-off and insolvency in Metal Manufacturers Pty Limited Gavin Morton as liquidator ...

Initial industry views on the parliamentary joint committee on corporate insolvency

23/10/2022

PJC Insolvency Inquiry 2022

While submissions to the parliamentary joint committee on corporate insolvency are not due until 30 November 2022, some indication of ...

The annual reports of the insolvency regulators

23/10/2022

AFSA annual report ASIC annual report

Public sector annual reports nowadays are often more inward looking than in the past, agencies being required to report on ...

International insolvency regulators’ conference – some current comparative issues

The International Association of Insolvency Regulators’ Annual Conference was held in England from 26-29 September 2022. Australia’s reported contribution to ...

Corporate plans of the insolvency regulators

08/09/2022

AFSA corporate plan ASIC corporate plan

The corporate plans of Australia’s two insolvency regulators have been released – AFSA and ASIC In order to assist in ...

Insolvency law ministers – personal, corporate, Indigenous, cross-border, employment and more

18/08/2022

Ministers

Relevant federal ministers whose portfolios involve insolvency law are primarily Mr Mark Dreyfuss QC as Attorney-General, Dr Jim Chalmers as ...

Oversight of deregistered companies

12/08/2022

Company deregistrations for failure to return statutory forms and pay fees have increased from nearly five times the number of ...

Judicial Impartiality and the Law on Bias

04/08/2022

judicial impartiality ALRC 138 bias independence

The Australian Law Reform Commission’s 600 page report on judicial impartiality – Without Fear or Favour: Judicial Impartiality and the ...

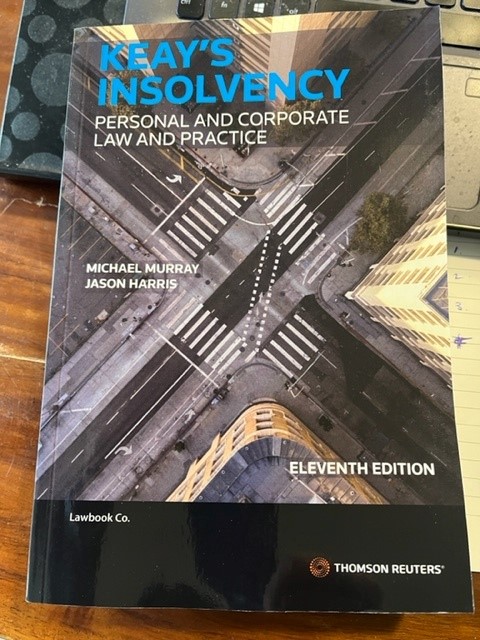

Keay’s Insolvency – Personal and Corporate Law and Practice, 11th ed, 2022

03/08/2022

We are pleased to have published the 11th edition of our textbook, Keay’s Insolvency – Personal and Corporate Law and ...

Reprimand and more for a liquidator – that’s about as much as we know

By a media release ASIC has reported that a disciplinary committee has decided to reprimand a liquidator, Nicholas Crouch, under ...

Association of Independent Insolvency Practitioners’ Third National Insolvency Conference

01/07/2022

AIIP ASIC ATO Fair Entitlements Guarantee - FEG

“Are you ready to rumble” in the insolvency jungle was the opening question at the Association of Independent Insolvency Practitioners ...

Insolvency practitioner [over]-regulation in Australia – an update

19/06/2022

AIIP ARITA ASIC UK regulation

While the UK is reviewing its insolvency practitioner (IP) co-regulation system, Australia’s direct regulation, with minimal but expansive co-regulation, might ...

Personal insolvency law and policy under the new Labor government in Australia

06/06/2022

INSOL Academics personal insolvency Attorney-General

With the Attorney-General Mr Mark Dreyfus QC in the process of picking up police and other responsibilities from the disbanded ...

Insolvency practitioner regulation – an Australian story

18/05/2022

practitioner regulation co-regulation

With the UK government rethinking the regulation of its insolvency practitioners (IPs), moving away from co-regulation to a system more ...

FEG claim against receivers over circulating assets

The Fair Entitlements Guarantee [FEG] scheme through the Commonwealth has obtained orders delaying the deregistration of a company to allow ...

UK insolvency review – “better outcomes from insolvency and increased returns to creditors”?

20/04/2022

UK insolvency INSOL International

The first and rather glowing report on the operation of the Insolvency (England and Wales) Rules 2016 has been issued ...

Government’s law reform of schemes of arrangement a “complete waste of resources when the core problem brewing is in the SME market”

14/03/2022

schemes of arrangement MSME

Some may agree or not with the “blunt” submission of an Australian liquidator and trustee on the government’s review of ...

Diversity and inclusion in insolvency

Diversity in the qualifications, experience, knowledge and abilities of those in the insolvency industry is the subject of this article, ...

“Voluntarily becoming bankrupt” – the new bankruptcy process

22/02/2022

debtors petitions AFSA

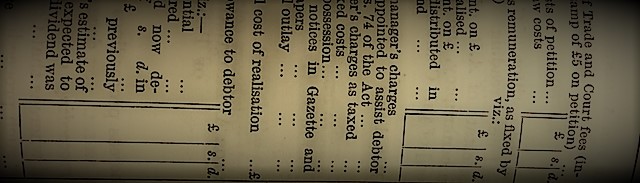

A person goes voluntarily bankrupt in Australia by completing an online “Bankruptcy Form” with the Official Receiver. What is now ...

Company owners and sole traders

11/02/2022

In the government’s proposed 5 year review of the Insolvency Law Reform Act 2016 changes, one particular issue needing attention ...

Categories

Main Menu