Inquiries conferences and reports

Gender, and diversity, in insolvency practice, continued

The July 2023 PJC report into corporate insolvency[1] makes recommendations on the “problem” of the limited female representation among liquidators, ...

UK’s review of its 2020 insolvency law reforms, with Australia compared

09/07/2023

Insolvency Service UK monitors - UK CIGA - UK

The quality of a recent UK review of its 2020 insolvency law reforms is compared with the approach taken in ...

Increase in Australian insolvency numbers

04/07/2023

bankruptcy Statistics PJC Insolvency Inquiry 2022

Personal insolvency numbers show a continued increase in numbers but still well below past figures; on the other hand, corporate ...

Should the firms of insolvency practitioners be regulated, along with the practitioner?

While Australia is currently focusing on the standards of conduct of accounting firms, and their partners – see Ethics and ...

Personal insolvency statistics – March quarter increase; April monthly decrease

01/06/2023

AFSA Statistics

There is good and bad news in the latest personal insolvency statistics from AFSA. March quarter increase The full March ...

The respective complexities of corporate and personal insolvency

15/05/2023

PJC Insolvency Inquiry 2022

A question on notice of 1 March 2023 was asked by the chair of the Parliamentary Joint Committee on Corporate ...

Anti-money laundering laws to be improved, including registers of beneficial owners

11/05/2023

AUSTRAC Register trusts PJC Insolvency Inquiry 2022

The 2023 budget has allocated funds for action on Anti‐Money Laundering and Counter‐Terrorism Financing (AML) laws, including a beneficial ownership ...

World Bank’s B-Ready Report on country business systems, including on the efficiency of corporate insolvency systems

05/05/2023

World Bank B-Ready report SME

This explains the World Bank’s new Business Ready initiative, which will report on the business systems of up to 180 ...

Personal insolvency statistics – March 2023 – beginnings of an increase?

28/04/2023

AFSA Statistics

The latest personal insolvency statistics released by AFSA for March 2023 show an increase in number over February but still ...

Insolvency law reform in Australia – three underlying concerns

06/04/2023

PJC Insolvency Inquiry 2022

With over 70 submissions from a wide variety of stakeholders and numerous answers to questions on notice, the parliamentary joint ...

Personal insolvency numbers – an increase or a decrease?

While AFSA reports that personal insolvencies increased in number in February 2023, to 796, from 772 in January, this was ...

ASIC’s insolvency law enforcement role

27/03/2023

ASIC PJC Insolvency Inquiry 2022

The Senate Economics References Committee is loading up submissions received on its reference into ASIC’s capacity and capability to “undertake ...

Attorney-General’s Roundtable on Personal Insolvency

23/03/2023

A summary of priority issues discussed at the Attorney-General’s personal insolvency law reform roundtable held on 2 March 2023 has ...

Personal insolvency reform in Australia

03/02/2023

personal insolvency PJC

The government is convening a “national roundtable with key stakeholders” on 2 March 2023 in relation to personal insolvency law ...

How low can we go – funding the insolvencies of assetless estates

20/01/2023

low fee insolvencies Russia articles General

Obvious as it is to say, insolvency involves limited or no money, and how to fund its existence as a ...

ASIC’s report on small business corporate restructurings under Part 5.3B

I am dubious about many of the outcomes touted for insolvency “restructurings”, or at least without the negative outcomes reported ...

Bankruptcy data 2021-2022 – rates of return, fees etc

07/01/2023

data Statistics

At the end of 2022, AFSA quietly released detailed data on the operation of the personal insolvency system in 2021-2022. ...

Business bankruptcies – 6,000 to 9,000 each year

04/01/2023

PJC Insolvency Inquiry 2022

Given that ‘small business’ itself is defined in various ways, none of which is based on the legal structure of ...

Failing fast … five hundred and something days to wrap up a business?

04/01/2023

At the PJC inquiry into corporate insolvency, in the context of the 2015 Productivity Commission (PC) Report on Business Entries ...

Parliamentary insolvency inquiry – the business model of insolvency firms

02/01/2023

PJC Insolvency Inquiry 2022

Some fundamental issues about the operation of insolvency law and practice are being raised in the joint parliamentary committee inquiry ...

The gender gap in insolvency

14/12/2022

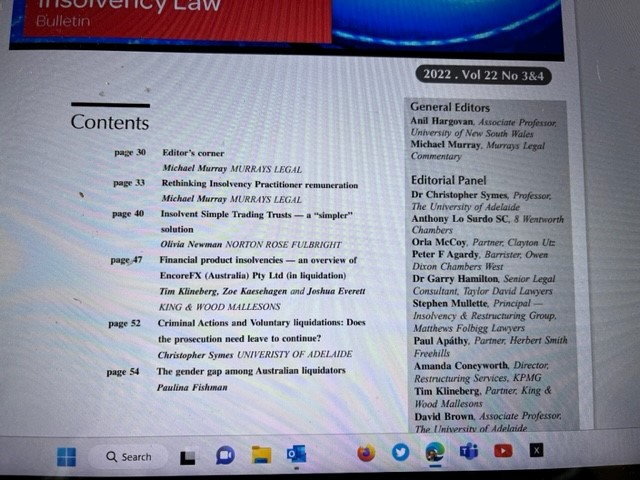

gender Insolvency Law Bulletin gender essentialism

An article in the latest Insolvency Law Bulletin – The gender gap among Australian liquidators,[1] by Paulina Fishman – comments ...

The latest Insolvency Law Bulletin – remuneration, trading trusts, financial product collapses, gender, and more

06/12/2022

gender trading trusts

In the latest issue of the Insolvency Law Bulletin, we have an article on a simpler solution to insolvent trading ...

PJC insolvency inquiry – deregistered companies submission

16/11/2022

assetless companies PJC Insolvency Inquiry 2022

An early submission to the Parliamentary Joint Committee inquiry into corporate insolvency from Mr Russell Morgan, liquidator, of 15 November ...

A productive insolvency regime – who knows?

15/11/2022

In the various calls for a holistic review of Australian insolvency law, there is little explanation of what exactly needs ...

Categories

Main Menu