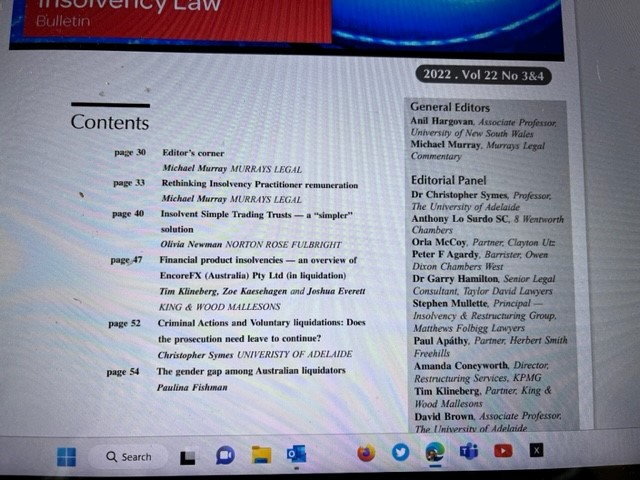

In the latest issue of the Insolvency Law Bulletin, we have an article on a simpler solution to insolvent trading trusts, by Olivia Newman, of Norton Rose Fulbright, to limit ipso facto clauses terminating an insolvent trustee. This would be in the interests of the appointed liquidator retaining the right of sale and thereby avoiding the need for costly court application. This is now the more pertinent given the parliamentary joint committee inquiry into corporate insolvency law, one of its terms of reference raising this very issue.

And in light of certain crypto and other financial house collapses making headlines, a team from King and Wood Mallesons – Tim Klineberg, Zoe Kaesehagen and Joshua Everett – offer us their Financial product insolvencies – an overview of EncoreFX (Australia) Pty Ltd (in liq) – involving a foreign exchange risk management and global payment service provider which became subject to volatile movements in the AUD/USD exchange rate and thereon to urgent margin calls against certain of EFX customers with large exposures. The story is familiar.

Professor Christopher Symes of the University of Adelaide explains that court leave is not required to bring criminal proceedings against a company in voluntary liquidation, in view of the wording in s 500(2) of the Corporations Act – preventing any “action or other civil proceeding …” being commenced against the company: see Criminal Actions and Voluntary liquidations: Does the prosecution need leave to continue? About which the Bulletin complains that it is yet another example of the continuing and unnecessary differences in Chapter 5 of the Corporations Act between compulsory and voluntary winding up powers and duties, all based on “an accident of history”. New Zealand corporate insolvency law carries no such distinction. Can we just adopt NZ law?!

And I offer some alternative perspectives on the remuneration of liquidators and trustees, covered in a separate blog comment.

The industry itself is low on female representation, and an analysis in The gender gap among Australian liquidators, by Paulina Fishman, shows the extent of the divide, by firm. Our author notes that AFSA has taken the step of allocating at least 20% of transferred personal insolvency matters to female trustees, no doubt with relevant exemption granted under the Sex Discrimination Act 1984. The benefit of having gender diversity in insolvency is less addressed and explained in the literature, other types of diversity, for example as to qualifications, more so. The need to broaden the qualifications of insolvency practitioners beyond accountants, and Australian accountants, has been the subject of some comments going back to the 1988 Harmer Report. That in itself may well assist with gender diversity.

As to the Bulletin, we have to point out that only 20% of the editorial panel are women but also of significance is that those contributing to the Bulletin are lawyers by far. Perhaps we should change our name?

Michael Murray

Co-editor

Insolvency [Law] Bulletin