Statistics

“Personal insolvencies increased in May 2024…” – by 3

29/06/2024

AFSA Statistics

AFSA reports that “personal insolvencies increased in May 2024”. They did – by 3 more than in April 2024. Personal ...

Personal insolvency numbers suffer a slight rise

29/05/2024

AFSA Statistics

There is not much to report from the latest personal insolvency figures, save for continued small increases over time. It ...

Small business sole trader insolvencies

08/03/2024

Statistics PJC Insolvency Inquiry 2022 MSMEs

A recent newspaper report on the trend of insolvencies in small business was interesting for the reason that it acknowledged ...

Personal insolvency figures – December 2023

01/02/2024

AFSA Statistics

Numbers of personal insolvencies in Australia continue to fall with the December 2023 figure down to 805 compared with 853 ...

Insolvency statistics 2023

30/12/2023

Statistics

Each of our insolvency regulators, ASIC for corporate, AFSA for personal, has issued its statistics for 2022-2023 right on the ...

Bankruptcy statistics – more of the same

01/12/2023

Statistics

With the annual personal insolvency statistics for 2022-2023 not yet released, AFSA has released figures for October 2023, showing 951 ...

Personal insolvency numbers – July-Sept 2023

27/11/2023

Statistics

With the annual personal insolvency statistics for 2022-2023 not due until December 2023, AFSA has released a quarterly report for ...

Marginal annual increase in personal insolvencies said to be in line with high numbers forecast

28/08/2023

AFSA remuneration Statistics PJC Insolvency Inquiry 2022

There was a total of 9,930 personal insolvencies in Australia in the 2022–23 financial year – around 4% higher than ...

Increase in Australian insolvency numbers

04/07/2023

bankruptcy Statistics PJC Insolvency Inquiry 2022

Personal insolvency numbers show a continued increase in numbers but still well below past figures; on the other hand, corporate ...

Personal insolvency statistics – March quarter increase; April monthly decrease

01/06/2023

AFSA Statistics

There is good and bad news in the latest personal insolvency statistics from AFSA. March quarter increase The full March ...

Personal insolvency statistics – March 2023 – beginnings of an increase?

28/04/2023

AFSA Statistics

The latest personal insolvency statistics released by AFSA for March 2023 show an increase in number over February but still ...

Bankruptcy data 2021-2022 – rates of return, fees etc

07/01/2023

data Statistics

At the end of 2022, AFSA quietly released detailed data on the operation of the personal insolvency system in 2021-2022. ...

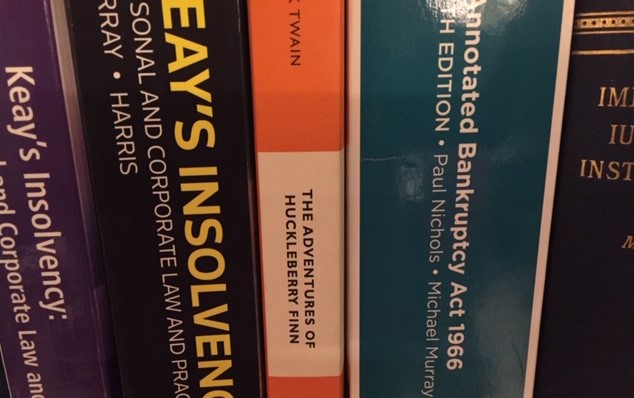

Insolvency returns to creditors and other fictions – reissued March 2022

Insolvencies average dividend returns to unsecured creditors of under 5 cents in the dollar, in some cases, under 1 cent. ...

Australian bankruptcy statistics 2019-2021

17/12/2021

Statistics

Numbers of Australia’s 3 year long bankruptcies were down 46.7% in 2020-2021, producing an average dividend of only 1.63c/$. The ...

High level of business bankruptcies in construction and retail

25/11/2021

Statistics

Latest figures show that nearly 60% of personal bankruptcies in the construction industry were involved in a business, with those ...

Data Availability and Transparency Bill and Australia’s SME insolvency reforms

08/11/2020

data Statistics Articles

Following on some decades of government inattention to the collection of adequate statistical data in insolvency, but with law reforms ...

Australian bankruptcies – falling numbers continue into the new financial year

30/07/2020

Statistics Temporary debt protection Articles

The dramatic annual fall in personal insolvencies in Australia to 30 June 2020 has continued with the second half of ...

Australian bankruptcies fall 42% over the ‘virus’ quarter

28/07/2020

Statistics COVID-19 Articles

Australian personal insolvencies in 2019-2020 have continued to fall, quite dramatically, of over 23% on last year, and over 35% ...

Down and down – Australian personal insolvency numbers

15/07/2020

Statistics Articles

The first fortnight of July (29 June to 12 July) saw a drop down from 611 to 587 of people ...

Australian personal insolvencies falling in number

31/05/2020

Statistics Articles

The number of personal insolvencies in Australia have been falling since the start of the corona crisis, which some might ...

Australia’s new fortnightly ‘COVID-19’ personal insolvency statistics

02/04/2020

Statistics COVID-19 General Articles

The Australian bankruptcy trustee and regulator AFSA has started to release fortnightly statistics on personal insolvencies in Australia[1] to assist ...

Insolvency returns to creditors and other fictions

Insolvencies average dividend returns to unsecured creditors of under 5 cents in the dollar, in some cases, under 1 cent. ...

Proportions of bankruptcies – a factor of 8.8 in Australia, but only 3.4 in England and Wales

20/08/2018

bankruptcy England and Wales Statistics Articles

While waiting to see if Australia’s parliament decides to introduce a one year period of bankruptcy, down from the current ...

What’s bankruptcy all about?

26/02/2018

AFSA bankruptcy General Statistics

Would you get out of bed in the morning, as an unsecured creditor of a bankrupt, for a dividend return ...

Categories

Main Menu