Case and statute law

ASIC’s power to wind up abandoned companies – a drop in the ocean?

20/03/2022

phoenix activity abandoned companies

ASIC has revised its guidance on the exercise of its powers to order the winding up of an abandoned company, ...

Government’s law reform of schemes of arrangement a “complete waste of resources when the core problem brewing is in the SME market”

14/03/2022

MSME schemes of arrangement

Some may agree or not with the “blunt” submission of an Australian liquidator and trustee on the government’s review of ...

Diversity and inclusion in insolvency

Diversity in the qualifications, experience, knowledge and abilities of those in the insolvency industry is the subject of this article, ...

A recusal application dismissed; ALRC report on Judicial Impartiality awaited

Justice Steven Rares of the Federal Court of Australia has rejected an application to recuse himself from hearing a matter ...

“Voluntarily becoming bankrupt” – the new bankruptcy process

22/02/2022

AFSA debtors petitions

A person goes voluntarily bankrupt in Australia by completing an online “Bankruptcy Form” with the Official Receiver. What is now ...

Liquidators’ examinations – a sea apart; legislative drafting – “a huge amount of material to wade through before they take a single step”

The decision of the High Court of Australia in Walton v Arrium [by majority (3-2)] adopting a broad interpretation of ...

Company owners and sole traders

11/02/2022

In the government’s proposed 5 year review of the Insolvency Law Reform Act 2016 changes, one particular issue needing attention ...

Proof of service of a bankruptcy notice – why it is, or why is it, so important?

24/01/2022

electronic service bankruptcy notices

A woman made bankrupt by a federal court registrar exercising judicial authority of the court has had her bankruptcy set ...

Proof of service of a bankruptcy notice – why it is, or why is it, so important?

24/01/2022

A woman made bankrupt by a federal court registrar exercising judicial authority of the court has had her bankruptcy set ...

Is it relevant outside Canberra whether a law is within or without Treasury’s portfolio?

With the government’s Treasury department busily introducing changes to the law to allow virtual meeting technology (VMT) for corporate liquidations, ...

Unconscionable and immoral corporate conduct – nothing personal

06/12/2021

penalties

In imposing a $153 million penalty on the Australian Institute of Professional Education, already in liquidation, for its “deliberate and ...

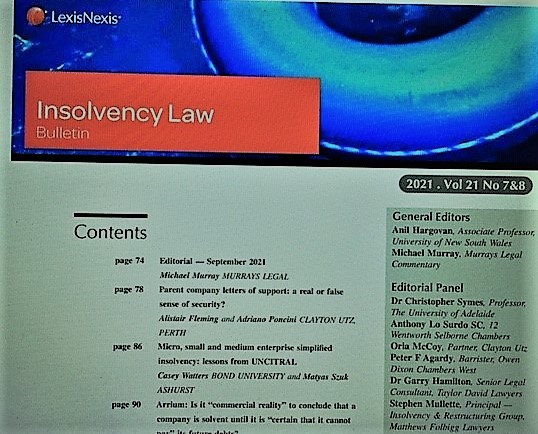

Insolvency Law Bulletin – October 2021 – Halifax, Arrium, MSME insolvency, letters of comfort, and (discretionary) trusts

31/10/2021

Insolvency Law Bulletin

The latest Insolvency Law Bulletin is out with a range of articles covering current and on-going issues in insolvency law ...

High Court confirms principles of judicial independence

06/10/2021

independence judicial independence

The High Court of Australia has found that social communications between a judge and a lawyer for a litigant in ...

Judicial impartiality report awaits the High Court decision in Charisteas – more dancing on pinheads

10/09/2021

ALRC judicial independence

Following a recent Australian Law Reform Commission seminar – Impartiality from both sides of the Bench | ALRC – held ...

Fees of insolvency practitioners and lawyers

15/08/2021

professional conduct legal costs legal profession

After Jason Harris and I wrote about Justice Michael Lee’s comments on the high charge out rates of insolvency practitioners, ...

What do creditors get from ‘successful’ recovery actions by insolvency practitioners?

08/08/2021

proportionality

A Judge has ordered that Trustees in bankruptcy file “evidence that identifies the benefits the creditors of the bankrupt estate ...

Cleaning up after failed oil and mining operations – new New Zealand laws, and other ideas

08/08/2021

disclaimer environmental mining oil

The cost of environmental clean-up of mining and other resource projects where the company has gone into liquidation is a ...

The contributions of bankruptcy trustees to AFSA’s regulation of criminal conduct

03/08/2021

CDPP criminal law offences - bankruptcy

Bankruptcy trustees, and liquidators, and creditors in insolvencies, contribute much to the government, in effect for free. In a recent ...

Assigning bankruptcy claims to a former trustee

24/07/2021

assigment of claims Official Assignee NZ

A 5 day bankruptcy hearing was cancelled in March 2021, in relation to matters occurring in 2012, being challenged in ...

Winding up Forum Finance

19/07/2021

just and equitable

In ordering that liquidators be appointed to Forum Finance Pty Ltd on 9 July 2021, the Federal Court explained the ...

Insolvency practitioner charge-out rates – the cost of carrying the State

16/07/2021

role of the state

In making a winding up order against Forum Finance,[1] Justice Michael Lee made this comment about the hourly fees of ...

Employees’ redundancy rights on the insolvency of their employer

15/07/2021

There are now a number of decisions from the Administrative Appeals Tribunal reviewing decisions of the Fair Entitlements Guarantee where ...

Cross-border insolvency protection of a ship on its way to Australia

An Italian shipping company – Michele Bottiglieri Armatore SpA – which is subject to Italian restructuring protection, a concordato preventivo ...

The insolvency rule in ex parte James – another in a series of cases ‘dancing on pinheads’

09/07/2021

ex parte James fairness

A trustee in bankruptcy in England rejected a £5.7m proof of debt lodged by the revenue authority [HMRC][1] on what ...

Categories

Main Menu