Law reform

Protected: A CALDB decision against a liquidator under the existing law, and how the new law will operate

22/12/2016

ad hoc committee AFSA ASIC Books, articles, commentary

There is no excerpt because this is a protected post.

The new effects test – and banks financing of distressed businesses

21/12/2016

Books, articles, commentary Law reform price signaling

The government has introduced the Competition and Consumer Amendment (Misuse of Market Power) Bill 2016 into parliament which would implement

Insolvency law reform – some harsh words

Murrays Legal recently reported a comment that our new insolvency law arriving in 2017 was the worst insolvency law reform we have

Insolvency Practice Rules 2016 released – Corporations and Bankruptcy

20/12/2016

Delay Insolvency Practice Rules Law reform

The Insolvency Practice Rules (Corporations) 2016 have now been released, without fanfare, and are on the Federal Register of Legislation. The Insolvency

ASIC’s data – the sale is off; now for some decisions….

The government has announced that it is not proceeding with the private sector bids to upgrade and operate ASIC’s registry functions.

What insolvency practitioners and lawyers and regulators need to know before too long …

The new insolvency reforms commence in about 9 weeks, on Wednesday 1 March 2017, under the Insolvency Law Reform Act

Prepacks – useful for law and accounting firms going under?

ASIC was recently asked in parliament for its views on “prepacks”, or pre-packaged insolvency administrations, with understandably cautious responses given.

Employees’ super – why trust the employer?

03/12/2016

Books, articles, commentary Law reform NOCLAR SGC

The Economics References Committee is to report by 22 March 2017 on various issues concerning the non-payment of superannuation by

Red Tape Committee and the words of Montesquieu

01/12/2016

Law reform red tape

Montesquieu’s words from the 18th century – “les lois inutiles affaiblissent les lois nécessaires” – are often quoted in the modern

Another new co-regulation regime for insolvency practitioners – NZ, following the UK and India

Just as India has introduced co-regulation of its new breed of insolvency practitioners, so has New Zealand acted on a

India’s new insolvency professionals regime

30/11/2016

Books, articles, commentary India Law reform

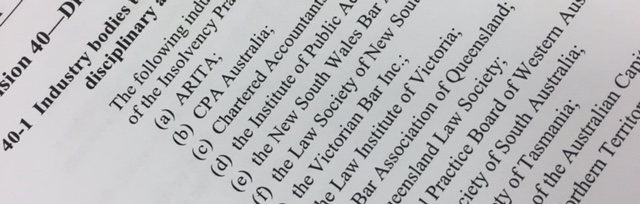

A major new insolvency regime commenced in India in May 2016. It introduces co-regulation of insolvency practitioners – IPs – through direct regulation by their

An expansion of the Banking Code, or is a change in the law needed?

The story about the conduct of bank officers in the Sydney Insolvency News prompts my suggestion for a widening of

European Commission proposes new approach to business rescue in Europe

On 22 November 2016, the European Commission presented a set of new European rules for business insolvency which member states

Late payers – what to do? and the ATO wants to know as well

17/11/2016

ATO Books, articles, commentary late payments Law reform

An inquiry into late payments to creditors has been commenced by the Australian Small Business and Family Enterprise Ombudsman. A

Australia’s draft Insolvency Practice Rules 2016 – some issues

The draft Insolvency Practice Rules raise a few fundamental issues about due process – natural justice, professional body involvement, confidentiality

Joint insolvency regulat(ion)

09/11/2016

AFSA ASIC Books, articles, commentary Law reform

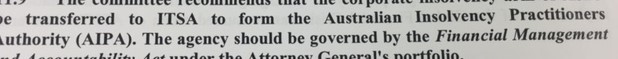

The bankruptcy regulator, AFSA, has announced a new approach to its regulation of the 200 trustees in bankruptcy in Australia, focusing

Traill Bankruptcy Conference – much better than the corporate alternative

07/11/2016

Conferences and events Law reform

Read the funding proposal for ASIC’s regulation of liquidators and understand why bankruptcy is so much more advanced. Corporate insolvency practitioners, lawyers

More (and more) government inquiries

31/10/2016

APRA ASIC Books, articles, commentary Insolvency Law Reform

Two important Senate inquiries of 2014 and 2015 that lapsed at the election have been reinstated, but still with long

Insolvency Practice Rules 2016 – draft for comment

12/10/2016

Insolvency Practice Rules Law reform

The Rules in support of the Insolvency Law Reform Act 2016 have been released in draft for comment by 4

Insolvency practitioners’ offence reporting

Although the government is trying to distance any connection between wrongdoing and a company going into liquidation or a person

Review of the big banks

03/10/2016

articles commentary Law reform

The Treasurer has asked the Standing Committee on Economics to inquire into and report on what is termed a Review

Another life insurance inquiry – respond by 18 November…..

16/09/2016

APRA articles commentary crisis management

The Parliamentary Joint Committee on Corporations and Financial Services is to report by 30 June 2017 on: the need for

Single touch payroll – on its way into law

15/09/2016

articles commentary Law reform Senate report

The Senate Standing Committee on Economics has given a report on the Budget Savings (Omnibus) Bill 2016 and has endorsed the Bill’s

Consistency in judicial decisions – Marlborough Gold Mines revisited

12/09/2016

articles Case law commentary Law reform

A rather unsatisfactory situation is developing in the nation’s federal and state superior courts in their exercise of shared jurisdiction

Categories

Main Menu