The future of insolvency practice lies in artificial intelligence (AI) which this article discussed. A list of selected articles and texts on AI and insolvency is offered.

The insolvency reforms of 2017 have been seen as a missed opportunity for Australia to introduce internet-based processes and approaches to its insolvency law, which, with its combination of rules and processes applied to specific sets of variable circumstances, lends itself to artificial intelligence (AI) applications.

AI can give insolvency practitioners (IPs) prompt assessments of volume data in relation to prior business financial stress and director transactions and tracking, with much of business itself becoming increasingly IT based, and IPs being faced with cyber-assets, cloud-based records and more. Technology assisted review (TAR) can speed up the identification of issues and trends and anomalies and draw attention to particular events and transactions and time periods of specific interest. Creditor claims can be assessed, and priority rules can be applied to different classes of assets, and securities. All this can be dome more readily than through human assessment but preserving that assessment and consequent strategy for the real issues identified.

Business itself can access apps for financial health checks, in particular for SMEs, to prompt early action, and creditors will be able to access data – the director identity number is a start – to reduce their trading risks. In the insolvency context, it is predicted that creditors’ access to AI processes

“may provide a far greater level of creditor empowerment and engagement than the ILRA reforms around creditors’ reasonable requests for information from an external administrator …”.

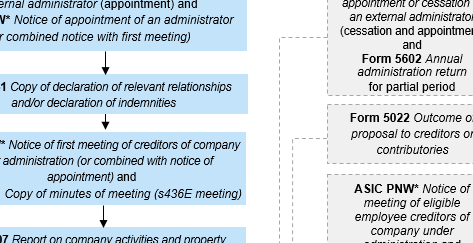

All parties will be assisted by coding of laws, with insolvency law now scattered through Acts, Rules, Regulations, regulatory guides, codes and court rules across corporate and personal. As one example, ASIC sets out 13 different complex flowcharts depending on the type of insolvency administration, this being one.

Coding development is led by the Digital Transformation Agency, Data61 of the CSIRO, NSW’s Rules as Code initiative and Austlii’s application of its DataLex AI software to various laws, among others.

Regulation will thereby be transformed, with the capacity to create evidence-based key performance measures of an administration, real time ‘lodgments’ and compliance metrics, and analyses of firms’ and practitioners’ performance as to the number and nature of matters handled, time taken, costs incurred and dividends paid. Already, AI is determining the most appropriate and experienced practitioners for particular jobs.

This will all be assisted through the administration of all insolvencies on a public platform, accessible in full by the regulator, and as allocated for each matter and its practitioner, with creditors and others having graded access. Statistics on insolvency will be extensive, available to guide changes in law and practice and monitor outcomes.

None of this happens simply by-passing laws, but IT focused laws can lead the way if supported by on-going government, regulator and professional support. The Corporations Amendment (Corporate Insolvency Reforms) Bill 2020 offers some progress – virtual meetings, electronic communications – only.

The many suggestions for government, regulators and professional bodies to work on realising the potential for AI and IT processes are yet to have much impact, with recent pre-Covid survey outcomes showing a low appreciation of and investment in such solutions. The virus has now imposed a more exacting timetable on many professions and businesses, insolvency being one.

This will be the subject of my session at a forthcoming insolvency conference, with, necessarily, others then explaining the risks and legal issues to be managed.

Suggestions and comments are invited.

Selected references (updated May 2021)

- IT and privacy and data collection in insolvency law, Michael Murray with A/Prof Stacey Steele (Melbourne Uni), Dr Cath Brown (QUT) and Dr Jennifer Dickfos (Griffith), 4 December 2020, QUT.

- Finnish Bankruptcy Act 2.0, Eurofenix Autumn 2019, p 28, Robert Peldán

- How Technologies and Innovation Are Driving Chinese Insolvency Law Developments: New Supreme People’s Court Bankruptcy Information Platform,Jin Chun, Associate Professor, Doshisha University, Kyoto, Japan, and Stacey Steele, Associate Professor, Asian Law Centre, Melbourne Law School, Australia.

- Going bankrupt in China, Bo Li Jacopo Ponticelli Working Paper 27501 http://www.nber.org/papers/w27501 July 2020 where the authors refer to, for example, their extraction from the Platform of “recovery rates obtained by different classes of creditors”.

- Supreme Court People’s Monitor, 7 August 2016.

- Rendición de Cuentes, Superintendencia de Sociedades, 2020.

- Necessary reforms: adaptation of insolvency regimes in Latin America due to the crisis, Carla Cervantes, INSOL International, 2020

- The impact of artificial intelligence on the insolvency profession(2017) INSLB, Dickfos, Brown and Smith.

- Insolvency in the digital age(2020) 20(7) INSLB 135, Myles Bayliss.

- Artificial intelligence, a no brainer for the insolvency industry, Eddie Senatore, 17 January 2018.

- AI and the Insolvency Profession: The State of Play(2018) 26 Insolv LJ 172, Dickfos.

- Positioning your firm for future growth 2020,Macquarie Bank Insolvency Industry Pulse Check, Australia.

- The Role of Artificial Intelligence (AI) and Technology in Global Bankruptcy and Restructuring Practices, INSOL International, July 2019

- Artificial Intelligence in insolvency work: Transforming critical care, Eurofenix 73, Autumn 2018, Joanna Goodman.

- Exploring opportunities for digital legislation, policy and rules, James Mohun and Colleen Considine, 10 April 2019, DTA

- The General Data Protection Regulation in Practice – A Global Survey, INSOL International, September 2019.

- Digital Transformation in Insolvency and Restructuring, C Cuninghame, [2021] 33(1) ARITA J 4.

- Keay’s Insolvency – a law reform launch of the 10th edition, 27 August 2018.