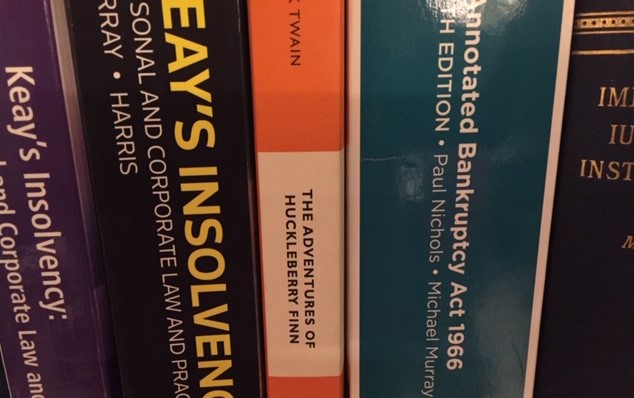

Insolvencies average dividend returns to unsecured creditors of under 5 cents in the dollar, in some cases, under 1 cent. For your unpaid debt of $10,000, you may receive $100, some months or years later. Much of insolvency is based on fiction.

I’d like to think that those in my field are familiar with my writings on insolvency law and its related issues.

Those same readers may not be familiar with my writings in fiction, made up stories, which I now feel the need to disclose.

The story

The fiction in fact appears all through what I write about insolvency, and the story goes like this.

Insolvency law is there ‘for the benefit of creditors’, that being a major purpose of the law, to recoup whatever assets the debtor has left, sell them and distribute them equally among the creditors, who are thereby grateful for their 70c in the dollar.

Liquidators and trustees have strong recovery powers to try to ensure this, including to unwind voidable transactions and recover preferences. We can read of their litigation successes in the law reports.

What happens at the end of the story is not so readily told.

At the end of an insolvency, we should look at what creditors actually received by way of payment of a dividend. The latest figures in bankruptcy reveal the reality of that end result, although these figures have in fact been telling us this for some time.

The statistics in bankruptcy for 2017-2018 are that unsecured creditors on average receive 1.61c in the dollar – 0.89c from estates administered by the Official Trustee, and 2.08c from registered trustee estates.

That average dividend return in bankruptcy of 1.61c in the dollar came out of these amounts:

Receipts by registered trustees in bankruptcy

$308m realised by trustees of which:

- $13m came from litigation recoveries,

- $37 from income contributions,

- $84m from other recoveries, and

- $174m from asset sales.

Payments

From that $308m:

- secured creditors received $84m [28%];

- unsecured creditors $52m [18%];

- “costs and other payments” were $87m [28%]; and

- trustee remuneration totalled $81m [26%].

Those who ask for more recovery rights might note the voidable transaction recoveries totalled only $13m of the $308, the costs of which might have totalled … $12 million?

“Costs” are the costs of administering a bankruptcy – for example legal fees, agent’s commission, settlement fees, brokerage on sale of shares etc.

“Other payments” include funds transferred to another trustee, trading payments, refund of surplus to debtor and realisations charges for period receipts.

Debt agreements

And we need to compare the humble debt agreement under Part IX of the Bankruptcy Act – dividends paid of $148m for an average return of 57c/$.

Corporate

Figures in corporate insolvency would not be much better.

For the benefit of creditors?!

The term ‘for the benefit of creditors’ appears thousands of times in the case law, from an early NSW 1802 decision to several in 2019; and throughout in the legislation. Bills presently before parliament are said to be for creditors’ benefit.

We are talking about monetary benefits – there are other benefits from an insolvency regime but, understandably, creditors are not that interested in those: the protection of the debtor, the collective and fair nature of the process, the economic reallocation of assets, the maintenance of confidence in security, and more elevated purposes.

Why is this?

Some may refer to the inherently expensive legal, accounting and regulatory attention given to insolvency, particularly disproportionate to the smaller end of the market, and refer to or blame government levies, legal fees, trustees’ remuneration, excessive regulation and reporting, pre-insolvency advisers and more. But even if one or more of those were reduced in amount, we are not looking at dividend returns jumping from 2% to 20%, more like 2% to 3%.

The reality may well be that those who go bankrupt, and companies that go into external administration, are insolvent because they have few if any assets remaining. And while some achievements may be made in finding assets, the costs of recovery, and the regulatory costs, consume them all.

Some thoughts

The present system is one that mostly feeds off itself in trying to meet the aims of insolvency law.

Whether bankruptcy last one month, one year or three, whether a trustee charges $10,000 or $15,000 in fees, or recoups more or less moneys from contributions, settles a claim for $30k or $60k, there would be little variation in dividend returns.

The exception to this is that there will always be exceptions.

What to do?

Two, of several, reform ideas to reduce this unproductive workload and reallocate the focus to other things are:

- Introduce a streamlined insolvency process for smaller companies. However that has already been rejected by the government, perhaps because there would be a risk that some companies would escape scrutiny, and creditors would lose out.

- Pay dividends only for those above 10%, or change the statutory threshold from $25 to $500; the remainder being paid into debt and small business counselling and advice, or some such other pre-emptive or ameliorative measures.

Comments welcome

If on the other hand, someone wants to say this analysis is wrong, that the system works and that worthwhile dividends are paid, I would be interested to hear, by way of statistically valid data. Which leads on to some further comments, and ideas, shortly.

Michael Murray