Ownership is sometimes but not always as it seems – presumptions for, presumptions against, and evidence

A ‘wife’ has succeeded before the High Court in preventing the ATO claiming what it argued was her husband’s interest in the family home in order to settle the husband’s tax debt, in excess of $9 million. Although the husband provided money for the purchase of the home, such that he, and the ATO, would […]

International insolvency regulators’ conference – some current comparative issues

The International Association of Insolvency Regulators’ Annual Conference was held in England from 26-29 September 2022. Australia’s reported contribution to the conference and some current international and comparative insolvency law issues are here discussed. The theme of the conference was ‘Post COVID – Recovery & Renewal in the Insolvency Profession’ and the conference “will seek […]

Corporate plans of the insolvency regulators

The corporate plans of Australia’s two insolvency regulators have been released – AFSA and ASIC In order to assist in understanding each report, this explanation is provided. AFSA comes under the Bankruptcy Act and the authority of the Attorney-General, ASIC comes under the Corporations Act administered by the Treasurer. The government Official Trustee administers most […]

Lawyers’ “grossly inflated” costs estimates

A Judge has dismissed a respondent’s application for security for costs that contained estimates that were “grossly inflated, far beyond the realm of what might be reasonably arguable as an estimate of the costs of an appeal”. The appeal was against an order dismissing a mortgagor’s claim that the mortgagee breached its duty under s […]

International insolvency case law from New Zealand and the UK

The universal nature of much of insolvency law is such that many of its principles apply across jurisdictions, with a commonality of application often found. This is the case in particular with closely comparable jurisdictions, such as New Zealand, and the UK. This benefits an increasingly international focus in business and insolvency law. Where there […]

Insolvency law ministers – personal, corporate, Indigenous, cross-border, employment and more

Relevant federal ministers whose portfolios involve insolvency law are primarily Mr Mark Dreyfuss QC as Attorney-General, Dr Jim Chalmers as Treasurer and Ms Julie Collins as the Minister for Small Business. Other relevant ministers cover employment law and FEG, and Aboriginal and Torres Strait Islander corporations. It is useful even necessary to know the […]

Oversight of deregistered companies

Company deregistrations for failure to return statutory forms and pay fees have increased from nearly five times the number of companies liquidated in 2016 to thirteen times in 2021. Speculation as to the reasons should be followed up by closer investigation. ASIC has released annual data on the deregistration of companies under s 601AA and […]

One small business restructuring practitioner

Reforms to corporate insolvency laws commenced on 1 January 2021 to assist companies with liabilities less than $1 million. These reforms under Part 5.3B Corporations Act included a new debt restructuring process for incorporated businesses, and a new simplified liquidation pathway. A new class of registered liquidator who can only undertake small business restructurings (SBR) […]

Judicial Impartiality and the Law on Bias

The Australian Law Reform Commission’s 600 page report on judicial impartiality – Without Fear or Favour: Judicial Impartiality and the Law on Bias (ALRC Report 138) has been released. It had been given to the government in December 2021 but awaited tabling in parliament. The report makes many recommendations about supporting and ensuring judicial impartiality […]

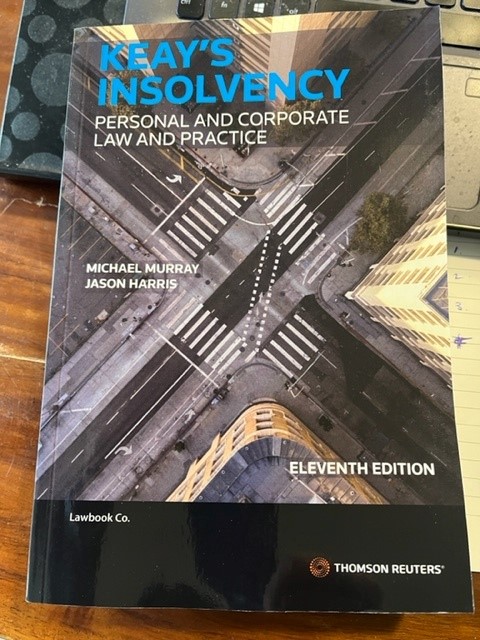

Keay’s Insolvency – Personal and Corporate Law and Practice, 11th ed, 2022

We are pleased to have published the 11th edition of our textbook, Keay’s Insolvency – Personal and Corporate Law and Practice, some four years after the 10th edition in 2018. This edition involved some substantial revision given what has been and remains a rather tumultuous four year period both socially and economically. For all that, […]

Try to resolve unpaid debt early, and leave insolvency as a “last resort”

Each of AFSA, ARITA and Financial Counselling Australia has issued a statement calling for better processes for resolution of claims for unpaid debt – Australians reminded of best practice approach to debt disputes as economic challenges continue, to address the problem early and to understand the options available to resolve debt disputes before formal insolvency […]

Define “insolvency” – legislative drafting continued

In bills before the new 2022 parliament, our legislative drafters have continued with their consistent approach in relying upon 19th century colonial bankruptcy law to define personal insolvency. Section 501K of the Federal Environment Watchdog Bill 2021 allows the Governor-General to terminate the appointment of the CEO if the CEO ….. becomes bankrupt; or applies […]

Class actions and litigation funding – New Zealand law reform report

While Australia is in the midst of some potential change in the law about litigation funding,[1] the New Zealand Law Commission has delivered its long-awaited report – Class actions and litigation funding – on what is a yet to be developed feature of that jurisdiction. See Law Commission publishes final report on class actions and […]

Insolvency practitioner remuneration revisited

International Insolvency Research Symposium.M Murray.RemunerationRevisited July 2022 – final This is a paper I gave at the recent International Insolvency Research Symposium on what I termed “revisiting insolvency practitioners’ remuneration”, offering a different focus from that of controlling and oversighting to one of examining the work actually needing to be done in an insolvency for […]

Reprimand and more for a liquidator – that’s about as much as we know

By a media release ASIC has reported that a disciplinary committee has decided to reprimand a liquidator, Nicholas Crouch, under s 40-55 of Corporations Act Schedule 2. See 22-171MR Disciplinary committee decision – Nicholas Crouch | ASIC – Australian Securities and Investments Commission According to the “reprimand” document published by ASIC, Mr Crouch was found by […]

Insolvency law reform – conference paper

This is the paper given by Professor Jason Harris and myself at the Society of Corporate Law Academics (SCOLA) conference on 4 July 2022, at the University of the Sunshine Coast. It concerns our views that the insolvency system in Australia needs re-thinking, before any attention is given to reform of the insolvency laws operating […]

Association of Independent Insolvency Practitioners’ Third National Insolvency Conference

“Are you ready to rumble” in the insolvency jungle was the opening question at the Association of Independent Insolvency Practitioners conference at the Hyatt Hotel in Canberra on 23-24 June 2022 and those two days were indeed a ringside rumble with 150 participants taken through many contentious issues in current insolvency practice. Opening on Thursday […]

Can insolvency practitioners afford to be generous?

The Australian bankruptcy regulator, AFSA, has published what it terms a series of “exemplar behaviour case studies [to] showcase examples of best practice from the insolvency sector”. One case study raises the issue of how much unremunerated work trustees perform and how and how that is paid for and by whom. In one example, the […]

Insolvency practitioner [over]-regulation in Australia – an update

While the UK is reviewing its insolvency practitioner (IP) co-regulation system, Australia’s direct regulation, with minimal but expansive co-regulation, might also come up for review. In the meantime, New Zealand has settled in to its newly created co-regulation without much ado, or cost. Perhaps we all overthink the issue of IP regulation, or overstate IPs’ […]

Who should pay for the costs of the administration of an insolvency?

A debtor in Australia pays no fee to have themselves made voluntarily bankrupt. If that does not seem odd, then it should be further explained that we are one of the only jurisdictions to impose no fee. But the ‘fee’ to wind up the debtor’s company can be a few thousand dollars. [This post was […]

Personal insolvency law and policy under the new Labor government in Australia

With the Attorney-General Mr Mark Dreyfus QC in the process of picking up police and other responsibilities from the disbanded Home Affairs and deciding upon priorities in his department among anti-corruption, the rule of law, merit-based tribunal appointments and constitutional change, he might also like to reconsider his responsibility for personal insolvency law. Mr Dreyfus […]

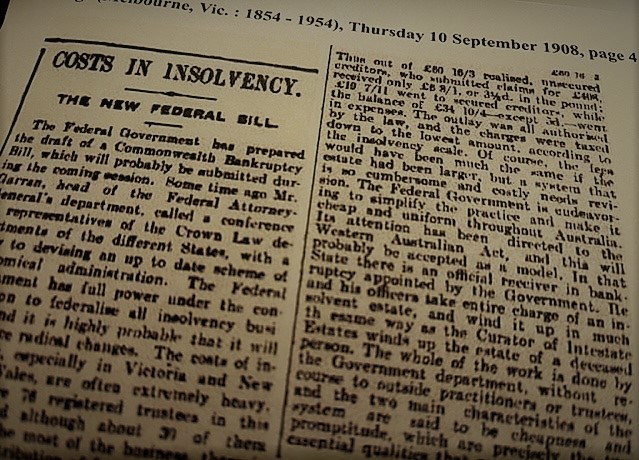

“The [too high] costs of insolvency”?

The Age newspaper in Australia has reported on what it describes as the “often extremely heavy” costs in administering insolvencies “which generally come out of the pockets of creditors who have already suffered”. It reports on some work of “extreme simplicity” charged at high rates and it refers to the many fees that “swallow up […]

Insolvency practitioner regulation – an Australian story

With the UK government rethinking the regulation of its insolvency practitioners (IPs), moving away from co-regulation to a system more like Australia’s direct government regulation model, it will be interesting to see in which direction Australia heads with its IP regulation, if at all. Its review of these processes was foreshadowed back in 2015, when […]

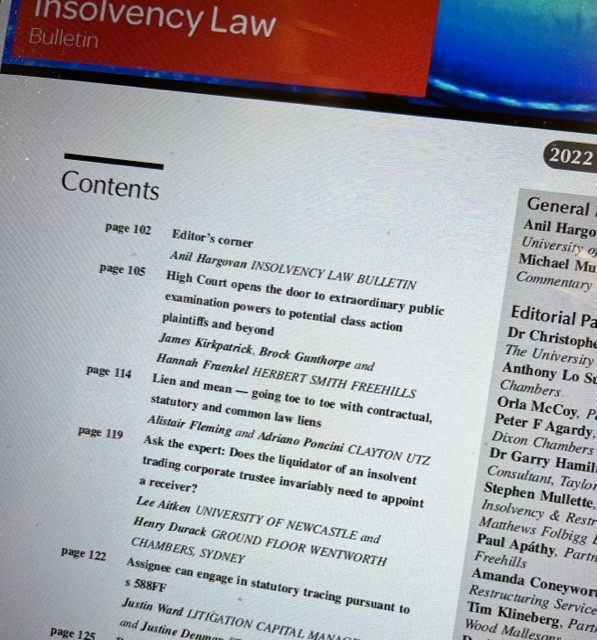

Insolvency Law Bulletin – the latest on examinations, liens, receivers, tracing and winding up

Examinations The latest Insolvency Law Bulletin looks at the High Court’s recent decision in Walton v ACN 004 410 833 Limited (formerly Arrium Ltd) (in liq) [2022] HCA 3 extending the scope of the examination power to potential class action plaintiffs – High Court opens the door to extraordinary public examination powers to potential class […]