Examinations

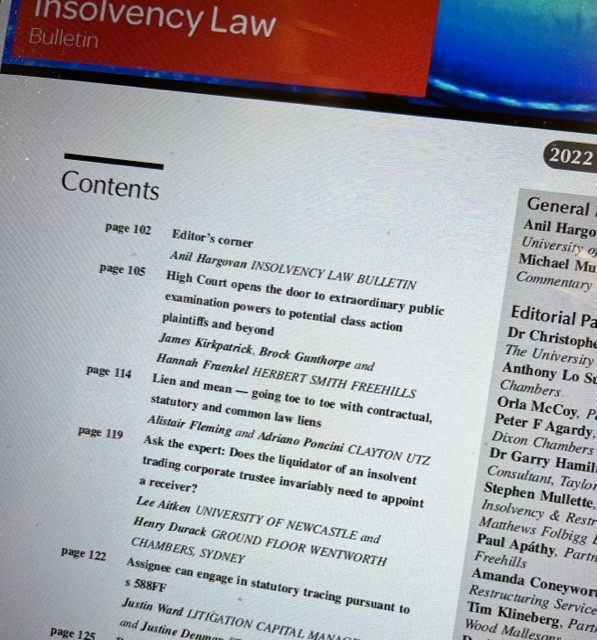

The latest Insolvency Law Bulletin looks at the High Court’s recent decision in Walton v ACN 004 410 833 Limited (formerly Arrium Ltd) (in liq) [2022] HCA 3 extending the scope of the examination power to potential class action plaintiffs – High Court opens the door to extraordinary public examination powers to potential class action plaintiffs and beyond by James Kirkpatrick, Brock Gunthorpe and Hannah Fraenkel. That outcome seems odd, and given certain political views about class actions, may prompt some change to the law. To what extent it prompts any change in practice we will need to wait.

Liens

The Bulletin has a very comprehensive and impressive analysis of liens – Lien and mean — going toe to toe with contractual, statutory and common law liens, by Alistair Fleming and Adriano Poncini – which pertinently refers to the fact that during the pandemic and continuing we are seeing supply chain disruption, freight backlogs and delays and more each of which create “fertile ground for personal property disputes”. The focus of the article is on lien claims — which arise through contractual arrangements, largely governed by the Personal Property Securities Act and/or through statute or common law, such as warehouseman and storage liens. While the PPSA is useful, “it is not a silver bullet” and both contractual liens and statutory liens can be subject to challenge, with suggestions made as to protections available.

Receivers appointed to sell trust assets

Two ‘experts’, an academic Lee Aitken and a barrister Henry Durack, ask whether a liquidator of an insolvent trading corporate trustee invariably need to appoint a receiver, or be appointed as receiver? Ask the expert: Does the liquidator of an insolvent trading corporate trustee invariably need to appoint a receiver? This seems to be the usual practice, although cumbersome, expensive and often impractical. For that reason, Treasury’s recent law reform paper asked whether the power of an insolvency practitioner to administer the trust assets and liabilities be expressly provided for in the law, and further, subject to a contrary order by a court, should the same insolvency practitioner be able to administer both the company assets and liabilities, and the assets and liabilities attributable to any trusts for which the company is trustee?

While it is said to have been the lawyers many years ago that resisted the law reform changes recommended by the Harmer Report, the Law Council now agrees. As its submission says, “the uncertainty has spawned many, many Court applications (in particular, for the appointment of liquidators as the receivers of trust property, with power to sell or dispose of it)”, pointing out that such applications are expensive (starting at $10,000) and they consume valuable court time and resources.

Statutory tracing under s 588FF, on assignment

And the use of statutory tracing is available to a liquidator, in pursuing a s 588FF claim, and thereby to an assignee of the liquidator’s claim – Assignee can engage in statutory tracing pursuant to s 588FF, by Justin Ward and Justine Denman. The liquidator had assigned to Fitz Jersey his entitlement to make an application under s 588FF. The Judge’s decision involved unravelling a complex set of transfers of assets apparently to avoid payment of an adjudicated sum, carried out in haste – “920 The pace with which matters progressed from mid-January 2017 to 6 February 2017 shows that [certain defendants] had determined to … dispose of the vast bulk of the proceeds of the Adjudication Determination and the Garnisheed Amount as soon as possible”. The complex findings in relation to conduct and more and the orders made are at Fitz Jersey Pty Ltd v Atlas Construction Group Pty Ltd (in liq) [2022] NSWSC 394.

Assaf’s Winding up in Insolvency

As I say in my review of Assaf’s Winding up in Insolvency, it seemed a natural progression from my having earlier reviewed Simpson’s Bankruptcy Notices and Creditor’s Petitions. My review can speak for itself, as can the book. Despite the valiant efforts of the Harmer Committee to confine disputes, a reality is that the challenging of demands, and winding up applications, are very frequent. While one can understand demands being challenged, for a creditor to go ahead and obtain a winding up order does not, given the limited dividend returns paid in insolvencies, make much economic sense, save perhaps to be able to write off the debt, or to satisfy some sense of attaining justice.

Editorial

And of course there is an insightful editorial from Professor Anil Hargovan, as co-editor.

Contributions to the Bulletin at any time are welcome.

Michael Murray, Co-editor