Deregistered / dissolved companies – let them be?

The UK Insolvency Service has been granted new investigative and disqualification powers to regulate directors who ‘dissolve’ (in Australian terms, ‘deregister’) their companies to avoid paying their liabilities. This is under the Rating (Coronavirus) and Directors Disqualification (Dissolved Companies) Act 2021. If misconduct is found, directors can face serious sanctions, including court orders for compensation.[1] […]

Insolvent insolvency practitioners?

An Australian insolvency industry body – ARITA – has suggested that the law should be changed to allow insolvency practitioners (IPs) who themselves become insolvent, or their company, to nevertheless be permitted to remain registered to practice: Members facing financial distress, December 2021, version 1.0. This is in the context of advice given by ARITA […]

UK’s proposed single insolvency regulator – beware Australian comparisons [revised]

After some long period of deliberation, the UK government has decided to itself take a direct role in the regulation of its insolvency practitioners (IPs), which it likens to Australia’s approach, as one example, but, unlike Australia, the UK also proposes to regulate insolvency firms. The UK is therefore to do away with its current […]

Is it relevant outside Canberra whether a law is within or without Treasury’s portfolio?

With the government’s Treasury department busily introducing changes to the law to allow virtual meeting technology (VMT) for corporate liquidations, and liquidator job interviews, the latest being about polls and voting, it does not seem to be ensuring the same changes are made in personal bankruptcy law, although it is reverting to the “show of […]

Australian bankruptcy statistics 2019-2021

Numbers of Australia’s 3 year long bankruptcies were down 46.7% in 2020-2021, producing an average dividend of only 1.63c/$. The private profession, which handles about 20% of bankruptcies, paid out 2.37c/$. Their total remuneration of $69m came from total receipts of $274m. These figures come from AFSA’s annual administration statistics for the 2020-2021 and also […]

Australian MSME insolvency law reform

Australian lawyers are presently represented at an international gathering of experts to address the need for particular insolvency laws for small business in the wake of COVID-19, given the unique issues of financial distress involved in that sector: Working Group V: Insolvency Law | United Nations Commission On International Trade Law 13-17 December 2021. On […]

Unconscionable and immoral corporate conduct – nothing personal

In imposing a $153 million penalty on the Australian Institute of Professional Education, already in liquidation, for its “deliberate and protracted unconscionable conduct of a highly predatory nature“, a Judge expressed particular regret that the company’s former CEO, “Mr Amjad Khanche [is] not able to be made the subject of any liability or other adverse […]

Any insolvency remuneration review as sought by ASIC “would be unprincipled and ultimately, wholly pointless”

From the opening paragraphs, one can foresee the outcome of this decision, about ASIC’s “unprincipled and pointless” intervention to deny voluntary administrators of GD Pork their remuneration because of some claimed lack of independence: [2021] WASC 428. Jones and Smith had been appointed as the joint voluntary administrators of two related corporations in October 2018 […]

Do our insolvency laws suit small business failures?

In shopping for a suit recently, I noticed that the Big Store displayed its suits according to brand, which apparently suited the Store, or its supplier, but not the customer, or this customer. Hence, I went elsewhere. Insolvency service providers are like the Big Store in that they look at a customer – a business […]

High level of business bankruptcies in construction and retail

Latest figures show that nearly 60% of personal bankruptcies in the construction industry were involved in a business, with those in retail businesses comprising around 50% in their sector. Business bankruptcies totalled around 40% of all bankruptcies. Fortnightly bankruptcy and personal insolvency statistics | Australian Financial Security Authority (afsa.gov.au) Small business Persons operating their own businesses […]

An insolvency law reform inquiry? first things first….

The prospect of an inquiry into insolvency law was raised in a recent speech by the chair of the Australian Law Reform Commission, Justice Sarah Derrington. She noted that it has been over 30 years since the last inquiry, ALRC 45, the Harmer Report, of 1988.[1] We likewise think a new insolvency law inquiry is […]

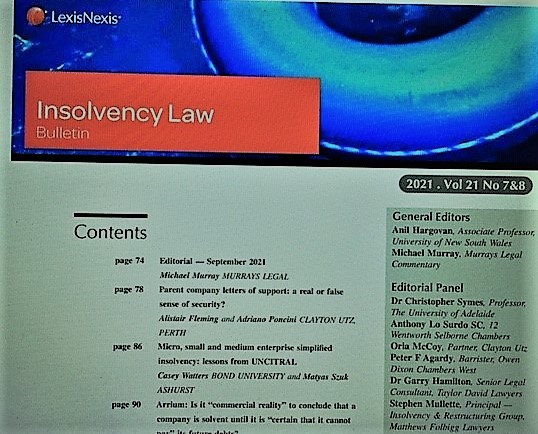

Insolvency Law Bulletin – October 2021 – Halifax, Arrium, MSME insolvency, letters of comfort, and (discretionary) trusts

The latest Insolvency Law Bulletin is out with a range of articles covering current and on-going issues in insolvency law and practice – so current that at times, the Bulletin has difficulty keeping up with current case law: (2021) 21(7&8) INSLB. We have an article on the cross-border hearings between the Full Federal Court of […]

Proposed New Zealand law restricting investigating accountants taking insolvency appointments

A bill introduced into the New Zealand parliament would mean that if ABC Insolvency Firm took a role as investigating accountant to assess and report to a bank on the security of the bank’s position, and whether the bank should appoint a receiver, the bank would not be able to engage ABC as receiver if […]

Rethinking insolvency law – a follow up

We are pleased to see some further responses to our early ideas on reform of the structure of the insolvency system. These were presented at a roundtable group in August 2021, and since then to government and others. They are significant root and branch issues given that they have rarely been part of the insolvency […]

Sole traders and insolvency

A report on the financial business health of Australian small business takes the novel approach of looking at sole traders. Behind that positive image of being one’s own boss and personal work/life balance lies the lack of protection from Australia’s severe bankruptcy laws. While the government has touted its new rather ineffective company insolvency laws, […]

Trust law and insolvency – views of the NSW Chief Justice; law reform prospects

A paper given by the NSW Chief Justice, Tom Bathurst – ‘Commercial trusts and the liability of beneficiaries: are commercial trusts a satisfactory vehicle to be used in modern day commerce?’ – discusses the need for law reform despite, as he says, insolvency law and trust law being “perhaps the world’s most unexciting and complex […]

High Court confirms principles of judicial independence

The High Court of Australia has found that social communications between a judge and a lawyer for a litigant in a matter that the judge was hearing raised a reasonable apprehension of bias. The family law matter commenced in 2006 and is still going. One consequence is that the Australian Law Reform Commission is now […]

Electronic delivery of documents in bankruptcy and liquidation – continued

In my earlier comments trying to work out why we now have unharmonized drafting approaches and rules for electronic service of insolvency documents, depending on whether corporate or personal insolvency is involved, I said I had asked relevant agencies in Canberra and that when any thoughtful reply arrived, I would report it. Electronic delivery of […]

Corporate Collective Investment Vehicles

The government is consulting on a Bill in line with what it says is its commitment “to establishing a commercially viable regime for corporate collective investment vehicles (CCIVs) from 1 July 2022. A CCIV is an investment vehicle with a corporate structure – designed to be an alternative to a trust-based managed investment scheme”. Corporate Collective […]

UK insolvency practitioners – “evidence of intimidation, deception, dishonesty and even misappropriation of assets”?

A very critical report on the insolvency profession in the UK – Resolving-Insolvency-APPG-on-Fair-Business-Banking-and-Humphries-Kerstetter.pdf (appgbanking.org.uk) has come from the All Party Parliamentary Group on Fair Business Banking, of September 2021. The dramatic opening lines of the report are these: The production of this report has been a sobering experience. We started out aware of a number […]

Reinventing the Australian Insolvency System

At a seminar on 4 August 2021, Jason Harris and I presented our ideas on reform of the insolvency system in Australia, which we have been developing for some time, including in our text book, Keay’s Insolvency++. We are saying that the state needs to take on a greater role in the structure and operation […]

Australian personal insolvency and small business reform in the wake of Covid

An overseas publisher has asked me to give an update on the latest in small business bankruptcy law in Australia, for a comparative article, the publisher asking what was the outcome of the various reforms in Australia proposed earlier in the year. That prompted me to review the state of play and come up with […]

Judicial impartiality report awaits the High Court decision in Charisteas – more dancing on pinheads

Following a recent Australian Law Reform Commission seminar – Impartiality from both sides of the Bench | ALRC – held on 19 July 2021, the ALRC advised that the “next progress points” for its inquiry are the judgment of the High Court of Australia in Charisteas[1] and the publication of the ALRC’s final report. That […]

Australia’s review of its insolvency safe harbour – more than a few issues to consider, but in the end, about not much

The terms of reference and what is called a ‘discussion paper’[1] for this review under s 588HA have been released, although the intention of the law is best found in the 2017 explanatory memorandum[2] which gives a range of examples and types of business that might use the law. Further background is found in the […]