Had the decision in Re HRL Limited (in liq) [2022] VSC 693, allowing a “success fee” on insolvency practitioner (IP) remuneration, been handed down in time, it would have rated a mention in my article Rethinking Insolvency Practitioner Remuneration, in the latest Insolvency Law Bulletin.

The article however tends to focus on the smaller end of the remuneration market though the point it makes, that small or large, work required of an IP can legitimately be disproportionate to the size of the estate, Re HRL notwithstanding. The focus should be on the work that is required in an insolvency, measured by reasonable time taken. The work can be considerable, for reasons given by Michael Kirby, quoted in the article. Nevertheless IP fees are generally seen as “too high”. It is as if we want an insolvency to be properly administered but don’t want to pay for it, or to at least acknowledge the time, skill and cost, that is involved.

If the time required is too much to justify the financial outcome – which is usually not much in the case of MSMEs – then perhaps we should be applying AI and computer-based processes to dispose of many insolvent companies, with the cost met by the state. The need to have some process of review is emphasised, for the sake of commercial morality and confidence, readily damaged if unpaid debt is blithely ignored.

As the article explains, in the end result IP remuneration seems to be funded by IPs applying higher charge out rates and billing fully on all estates with assets. It is in effect a de facto commission-based system, imposed on the large estates, quietly endorsed by the regulators, and courts, and the market. It is supplemented by IPs taking recovery proceedings to [indirectly] recoup unmet fees, by litigation funding, and now, by success fees. It is hardly a transparent process.

Unless the fee losses inherent in insolvency administration can be reduced by some role of government, or other means, taking account of the various issues raised in my article, perhaps we should simply allow IPs to charge on commission, like the Official Trustee. Commission based funding, with statutory minimum duties imposed, has behavioural incentives and disincentives at least comparable with time charging, and with success fees.

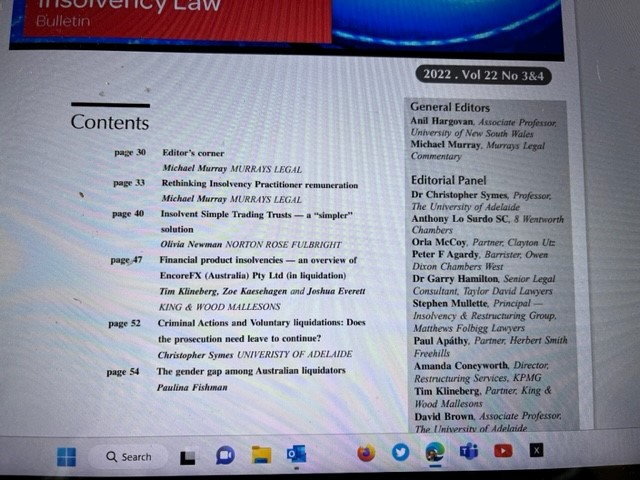

My article is here Rethinking Insolvency Practitioner remuneration — (2022) 22(3&4) INSLB 33.