Modern Commonwealth laws still rely on 1901 drafting precedents despite changes in the law over the last 116 years. As we all know, precedents are useful, but they must be used with care.

The Audit Act 1901 was one the first Acts of the new parliament of the Commonwealth of Australia. At that time, Australia had no bankruptcy law, instead we had insolvency laws of each of the different states.[1]

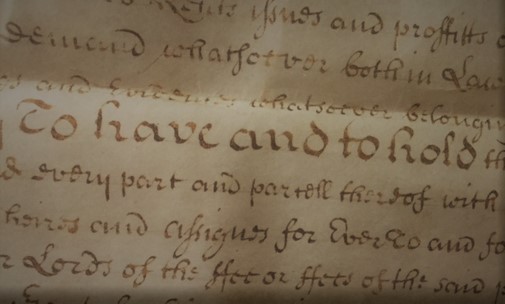

That is why section 5(2)(b) of the 1901 Audit Act provided that the Auditor-General was deemed to have vacated his office in the event of his insolvency, expressed in these rather quaint terms

“(b) if he becomes insolvent or bankrupt or compounds with his creditors or makes any assignment of his salary for their benefit or takes advantage of the provisions of any Act or State Act relating to insolvency or bankruptcy”.

Australia’s first bankruptcy law was the Bankruptcy Act of 1924 followed by our present Bankruptcy Act of 1966.

The term for a person who is bankrupt or who is in some other personal insolvency arrangement is now usefully stated as “an insolvent under administration”, defined in s 9 of the Corporations Act.[2]

In December 2017, the Rural Regional Investment Corporation Bill 2017 was introduced into parliament. Clause 26 provides that the responsible Ministers may terminate the appointment of a Board member if

“(a) the Board member:

(i) becomes bankrupt; or

(ii) applies to take the benefit of any law for the relief of bankrupt or insolvent debtors; or

(iii) compounds with his or her creditors; or

(iv) makes an assignment of his or her remuneration for the benefit of his or her creditors”. …

that is, in language of 1901. Applications to “take the benefit of any law for the relief of bankrupt or insolvent debtors”, or compounding with his or her creditors, or making an assignment of his or her remuneration for the benefit of his or her creditors”, mean little or nothing, even if, back in 1901, they once did.

And the drafting around the one relevant word – “bankrupt” – is such that a Board member is only prohibited from office if they become bankrupt during her or his term; an existing bankruptcy at the time of their appointment is not proscribed. There are many other such instances, in Bills and in Acts passed into law.

Consistency in legal drafting and terms is desirable; the drafting dangers of thinking up a new term are sometimes revealed.[3]

But in this case, ‘modern’ drafting should acknowledge the passing of our ‘new’ bankruptcy laws of 1924 and then 1966.

At least clause 26 is gender neutral.

This issue has previously been raised with the Office of Parliamentary Counsel, and for that matter, with some state parliamentary counsel.

================================

[1] Bankruptcy Act 1898 (NSW); Insolvency Act 1874 (Qld); Insolvent Act 1886 (SA); Bankruptcy Act 1870 (Tas); Insolvency Act 1915 (Vic); Bankruptcy Act 1892 (WA).

[2] Briefly, a person who is an undischarged bankrupt; or whose property is subject to s 50 or s 188 control; or a person subject to a Part X or Part IX debt agreement; including foreign equivalents.

[3] Oreb v ASIC (No 2) [2017] FCAFC 49

2 Responses

Bit like the prescribed form of Bankruptcy Notice continuing to refer to the Federal Magistrates Court of Australia which changed it name several years ago

Only a bit like.