ASIC reports that former registered liquidator Peter Andrew Amos was sentenced on 13 December 2024 in the District Court of NSW to four years imprisonment after pleading guilty to charges of dishonestly using his position with the intention of gaining an advantage for his business and himself contrary to s 184(2)(a) of the Corporations Act. 24-281MR Former registered liquidator Peter Amos sentenced to prison for dishonest use of position as external administrator | ASIC

The Court imposed a non-parole period of two years.

The Court heard that from 6 October 2016 to 31 December 2022, Mr Amos transferred $2,998,546.59 (plus $19,936.86 for other scheduled offences) from the accounts of various external administrations to his firm, Amos Insolvency, of which he was sole director and a shareholder. He was the appointed external administrator or liquidator of the companies.

Once transferred, the funds were used to pay unrelated expenses of Amos Insolvency and for Mr Amos’ personal purposes.

These offences occurred across five companies over a six-year period.

The matter was prosecuted by the Commonwealth DPP following an investigation and referral by ASIC as part of the ATO-led Serious Financial Crime Taskforce, of which ASIC is a member.

While the ATO Taskforce Chief welcomed the Court’s decision, saying that

‘this outcome sends a clear message to those who look to gain an unfair advantage – you will be caught,’

eventually, the fact that the offences occurred over a 6 year period hardly gives confidence in the regulatory arrangements of insolvency practitioners. That is, in the absence of a report from ASIC as to how these defalcations occurred for so long.

Necessarily, Mr Amos is no longer a registered liquidator, a role he had occupied since 2006.

Regulatory background

The regulatory background is that in April 2022, ASIC issued Mr Amos with a direction that he not accept further insolvency appointments due to his failure to lodge outstanding documents relating to an external administration: see IPSC s 40-15. From that point on he was unable to accept any new appointments as an external administrator.

ASIC’s, and AFSA’s, powers go back to the 2010 Senate Committee Report on ASIC Regulation and its recommendation 3 for a ‘flying squad’ regulatory approach be adopted, and that there be

“investigations of a sample of insolvency practitioners, some selected at random, others with the aid of a risk profiling system and market intelligence”.

The regulators’ powers to issue directions and suspend registration are broadly sourced from that Report.

After ASIC’s investigation had commenced, Amos requested that his registration as a liquidator be suspended. That suspension took effect from 4 February 2023.

Mr Amos did not renew his registration by 11 May 2023 which led to its automatic cancellation.

The fact that the matter was referred by ASIC as part of the Serious Financial Crime Taskforce, of which ASIC is a member, suggests that this came out of the generic Taskforce rather than from ASIC as the insolvency regulator with extensive powers given to it under the Corporations Act, and the ASIC Act. The role of the industry bodies tasked with insolvency practitioner regulation under the Corporations Act, in this case over a period of 6 years, seems to have been limited.

Sentence

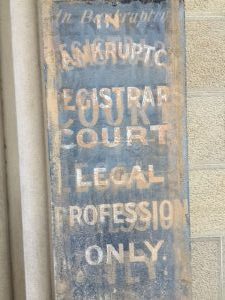

As to the four-year sentence, while the reasons of the Judge are not yet available, cases involving a breach of trust by, for example, a solicitor or other professional standing in a similar position of trust, generally call for a full-time custodial sentence unless there be some special or unusual features or circumstances. In a matter involving a solicitor taking trust moneys, the Court referred to

“the broader consequence for the legal profession resulting from disclosure that one of its members had stolen a significant sum of money from a trust which he was expected to administer. As has been noted on many occasions, offences of this kind are often hard to detect, a factor which places great weight on the public interest in an honest and accountable legal profession”: R v Jafari [2017] NSWCCA 152 at [101].

Insolvency practitioners hold higher positions of trust than lawyers.

Insurance?

Insurance required to be maintained by insolvency practitioners does not assist in cases of criminal defalcation by the practitioner.

The losses to creditors in the five administrations will no doubt be explained in ASIC’s report on the outcome of this matter.

The money?

As to the $3 million, there may yet be civil debt recovery or proceeds of crime proceedings instituted.

For further background, see Former liquidator sentenced to 4 years jail, 2 years non-parole – Murrays Legal

One Response

I thought that the fee paid per administration was intended, at least in , to resource the ASIC in conducting appropriate reviews. If my understanding is incorrect why then is it justified particularly where the vast majority of administrations provide little return to creditors