The Commonwealth Integrity Commission Bill 2020 is important in many respects and some would see the following aspect of it as not. But I’ll press on anyway.

Under s 220(2) of the Bill, the Governor-General must terminate the appointment of a commissioner (a CIC office holder) if he or she

“(i) becomes bankrupt; or (ii) applies to take the benefit of any law for the relief of bankrupt or insolvent debtors; or (iii) compounds with the CIC office holder’s creditors; or (iv) makes an assignment of the CIC office holder’s remuneration for the benefit of the CIC office holder’s creditors”.

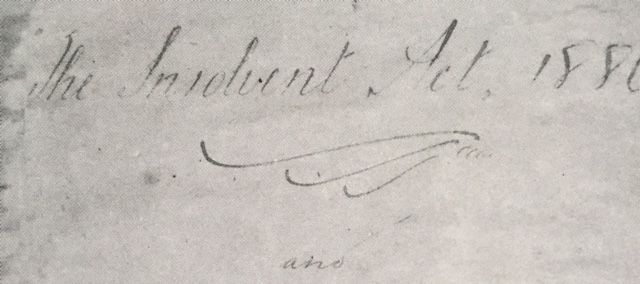

Apart from the admirable gender neutral terms, and the more modern “remuneration” rather than “salary”, those with some knowledge of bankruptcy law will recognise the 19th century colonial history behind that quaintly worded 2020 drafting.

In fact, as some will also know, the Audit Act 1901 was only the fourth Act of the new Commonwealth parliament. Its s 5(2) provided that the Auditor-General was deemed to have vacated his office-…

“(b) if he becomes insolvent or bankrupt or compounds with his creditors or makes any assignment of his salary for their benefit or takes advantage of the provisions of any Act or State Act relating to insolvency or bankruptcy …”.

That drafting was valid then, in 1901, but it is not in 2020. The definition needed is probably best found in s 9 Corporations Act 2001. Whether bankruptcy should automatically terminate an appointment is another matter.

Drafting laws is difficult and reliance on time tested precedents is expected, to a point.

But Commonwealth Parliamentary Counsel’s reliance on precedent wording from laws that can be traced back to federation and colonial bankruptcy law is not a good look.