The bankruptcy office – the Australian Financial Security Authority – is asking for comment on a revised form of “statement of affairs”, the list of assets and liabilities and other information that persons made bankrupt are required to complete: s 54 Bankruptcy Act.

AFSA says it has adopted a ‘human-centred approach’ to the design; and while it says it is working towards a digital option, its first goal is to improve the paper form.

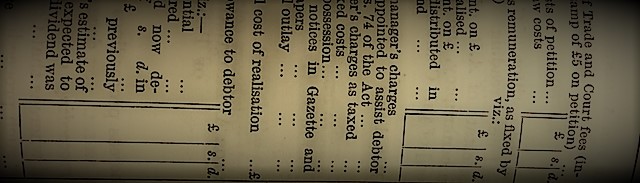

A combined petition and statement of affairs

AFSA proposes to combine the debtor’s petition and the statement of affairs into one document.

That may not work, because each document has a separate status at law and each needs to be recognised. The SOA is required to be filed by a person made bankrupt – s 54; and a SOA must (in most cases) ‘accompany’ a debtor’s petition presented to the Official Receiver: s 55.

AFSA also says it aims to reduce duplication of similar questions and also ask the right questions to prompt trustees’ further investigation.

The statement of affairs is to contain a significant amount of information, containing as it does a roadmap for trustees in assessing the bankrupt estate.

Legal significance

It is also legally significant in that:

- It must be completed by the actual person, although the draft form speaks of it being signed under a power of attorney, or administration order. The former does not seem possible, the latter is problematic in many states: see Bankruptcy and mental capacity;

- It must be substantially complete, or need only be substantially complete: s 55

- It marks the commencement of the three (or one year) period of bankruptcy: s 149

- Getting it wrong may not be able to be remedied: s 33A

- Right or wrong information in its can lead to criminal prosecution – for example s 265, 266; and lead to an objection to discharge being lodged – s 149D; and

- The SOA can be the subject of query and review by creditors, and it allows them for example to challenge the claim of another creditor: s 104.

Assets

The nature of assets is changing, as AFSA says, and assets such as intellectual property are now included, and digital assets, such as cryptocurrency.

Comment

Whether this long SOA will remedy the rather alarming figure of over half current SOAs being rejected, delaying the commencement of the bankruptcy, is the subject of this consultation.

Form design and consistency of approach is the subject of some focus in Australian government agencies, many others of which rely on statements of income, assets and commitments for example, for the purposes of eligibility for government services. It is assumed that this all of government approach is being followed by AFSA.

The RATA

It compares with the report as to affairs of ASIC – the RATA. That necessarily asks questions in a different way, given the corporate entity involved, but even then, there are common accounting standards as to the reporting of assets and liabilities, and common assets and creditors.

In particular, there is need to have consistency between the information sought from X as a debtor with the same financial and related information sought from X in their capacity as a director of a company in external insolvency administration under the Corporations Act; from creditors’ viewpoints, as well.

Oddly, the RATA must be filed with the court: s475(7) Corporations Act; this is not the case with the SOA.

No doubt AFSA and ASIC are working together on the SOA.

Statistics

The other purpose of any document like this is the large amount of potential data that it contains. The needs of research and analysis of the personal insolvency system can feed into what is asked in the SOA, as long as it is consistent with the law; for example, as to the intersections between bankruptcy and family law, and bankruptcy and company liquidation.

Comment needed

AFSA wants comment by 10 September, the day that parliament resumes, possibly to consider the proposed one-year bankruptcy and the reforms to debt agreements.