It is interesting to now see the clear limitations the government has placed on the protections offered by the COVID-19 ‘safe harbour’ reforms, in the latest extension of time of the operation of s 588GAAA Safe harbour–temporary relief in response to the coronavirus to 31 December 2020.

The limitation is that unless the company in question enters external insolvency administration by that date, no amount of incurring of debt related to the coronavirus in the ordinary course will be protected.

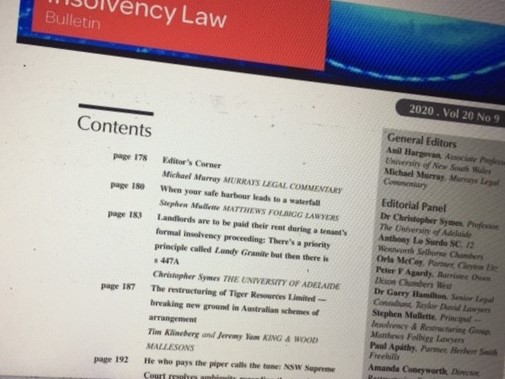

This was pointed out in an article in the recent issue of the Insolvency Law Bulletin, by Stephen Mullette,* in relation to the earlier extended date of 24 September 2020: (2020) 20(9) INSLB 180.

In Stephen’s article “When your Safe Harbour leads to a Waterfall”, he drew attention to the fact that the law required the company to enter external administration by 24 September 2020 for any protection to later be available to its directors.

As Stephen wrote

“if an appointment is made 1 day later the protection will be lost and the director will be exposed to a claim for insolvent trading for all debts incurred during the COVID-19 period”.

Thinking that could not have been the legislative intention, Stephen applied some sophisticated principles of statutory interpretation to s 588GAAA and the regulations to find an alternative outcome – “does s 588GAAA create a “power, right or liability”? Certainly not a liability, and probably not a power. …” – but left the question open.

That made it difficult for directors:

“Does the director take the risk and delay appointment of an external administrator in the hope that the company will never be wound up, or is the safer course for all companies at any risk to appoint an external administrator on or before” the due date?

But he then suggested that it may be remedied or made clear if any further extension were to be legislated – sunset over the waterfall – and a copy of the article was thoughtfully sent to Treasury.

It has not been remedied, as the next issue of the Bulletin will explain.

He concludes by pointing out the “significant marketing tool” that this drafting provides to insolvency practitioners, courtesy of the government,

“to urgently encourage those considering appointment of an external administrator to act urgently and make an appointment before [the due date] to have the best chance of their ship reaching shore”.

From a policy perspective, it is not so satisfactory. The reality is that few companies had been entering liquidation, up to 24 September, and if that trend continues to 31 December, then 588GAAA won’t be such a great help.

The day after, on and from 1 January 2021, it is proposed that SMEs have access to a new restructuring or liquidation regime.

A difficult decision

Directors of SME companies might have the difficult decision whether to enter liquidation on or before 31 December in order to secure the section 588GAAA protection; or risk trying for an SME arrangement, which if rejected, puts them in liquidation without 588GAAA protection.

Professor Jason Harris and I recently wrote that the proposed SME regime, with its legal and practical thresholds, has the potential to make the regime

‘ring hollow as a claytons’ reform.’

The same might be said of s 588GAAA.

* Matthews Folbigg Lawyers www.matthewsfolbigg.com.au

3 Responses

Dear Micheal

I had assumed that when you were writing with Jason Harris in a piece for an Oxford blog, this point was also made by you both, as you said ‘ the crunch would come in relation to either safe harbour provision when, if the company fails despite the safe harbour efforts, a liquidator reviews the conduct of the directors in terms of whether they adequately secured the safe harbour protection’.

Most advisers in published information have rightly told directors that these temporary measures were not a free pass, that the ‘ordinary course of business’ aspect was the real ambiguity, and that the normal duties of directors, and DPNs, persisted during the temporary period.

The safe harbour provisions and the Covid 19 safe harbour provisions clearly do not protect against DON or other equivalent liability of directors and that fact needs to be taken into account in any “Debt Arrangement” as presently proposed but not explained or DOCA. If the proposed @Debt Arrangement” extended to these liabilities their viability would be enhanced in the same way as if similar changes were made to Pt 5.3A.

Interesting to see that TMA have come out criticizing the above interpretation. I wonder if that is because ARITA are publishing the same views that you and Stephen are suggesting? It certainly suits TMA to push Safe Harbour as being the panacea for their clients’ fears. That will be based upon the best advice for their clients and not devastated restructuring budgets I am sure.