Australia’s draft Insolvency Practice Rules 2016 – some issues

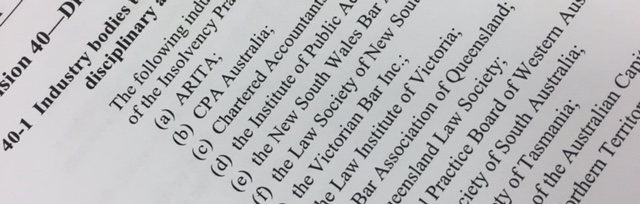

The draft Insolvency Practice Rules raise a few fundamental issues about due process – natural justice, professional body involvement, confidentiality and transparency, being covered by me at the Traill 4th National Bankruptcy Congress on 14 November 2016; and also about ordinary insolvency process – communications, service by post, time limits, and the telephone….. The rules are […]

Reasons for Queensland Nickel’s Special Purpose Liquidators being Appointed?

Special purpose liquidators have properly been appointed by the Federal Court to some aspects of the Queensland Nickel companies of Clive Palmer but it would have been useful to know, from the Court, why. In any event, the High Court has dismissed Mr Palmer’s constitutional challenge to examination summonses issued at the request of those […]

Special purpose liquidators – merely a creditor’s whim?

Insolvency law has a mixed view of its liquidators. On the one hand they are said to be of the highest integrity, qualified and experienced, officers of the court, exercising quasi-judicial authority, investigating misconduct and pursuing public interest issues. On the other, they are seen as being susceptible to bias in favour of the […]

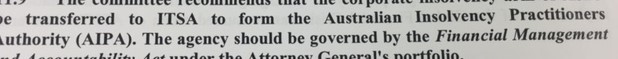

Joint insolvency regulat(ion)

The bankruptcy regulator, AFSA, has announced a new approach to its regulation of the 200 trustees in bankruptcy in Australia, focusing more on a trustee firm’s systems and controls and how or whether they serve to allow the trustee to meet the various legal and professional requirements. This more streamlined approach, coupled with the insolvency reforms coming […]

Traill Bankruptcy Conference – much better than the corporate alternative

Read the funding proposal for ASIC’s regulation of liquidators and understand why bankruptcy is so much more advanced. Corporate insolvency practitioners, lawyers and academics should attend the Rosie Traill Bankruptcy Conference on 14 November 2016, in Sydney, to find out how and why. Bankruptcy is the poor relation of insolvency law, with more professional, academic and media attention […]

Beneficial ownership of companies, and access to ASIC data

The government has invited us to “have our say” on what it says is “Australia’s first Open Government National Action Plan”, the draft plan being opened for public consultation on 31 October 2016. This express the government’s “ambitions” in a number of worthwhile areas. A beneficial ownership register for companies Many aspects of the Plan […]

More (and more) government inquiries

Two important Senate inquiries of 2014 and 2015 that lapsed at the election have been reinstated, but still with long reporting dates into 2017; and there is a new inquiry into ASIC’s enforcement powers. Many of these issues have been the subject of recommendations in earlier inquiries, with no action taken. Meanwhile, tax breaches, phoenix activity and other […]

ASIC before the Senate – no more scalps, goodness will prevail; complaints in the “thousands”; and the ASIC database

Senate questioning of ASIC does provide some useful information at times. In the inquiry into ASIC’s 2015 annual report by House of Representatives Standing Committee on Economics, on 14 October 2016, issues came up about: ASIC’s enforcement focus on getting “scalps”; its new behavioural economic focus on “what ‘good’ looks like” in the sectors it […]

Solomon’s Justice in Maritime China

The maritime court structure of China was first set up in 1984 and over the short period since then the 10 main courts have established a further 39 branch courts up and down the coast and along the Yangtze, surely the largest maritime court structure worldwide. Together these courts determine matters according to the Chinese Maritime […]

Insolvency Practice Rules 2016 – draft for comment

The Rules in support of the Insolvency Law Reform Act 2016 have been released in draft for comment by 4 November 2016. These follow an earlier statement of what the Rules would contain issued in 2014. The long delay has been the subject of comment on this site. The Rules The Rules are: Insolvency Practice Rules […]

New Zealand Voluntary Administration Law – an independence challenge to the administrators

“Pre-appointment work, including involvement in the drafting of a proposed deed of company arrangement, is not unusual in the corporate insolvency context and does not preclude subsequent appointment as a deed administrator. Indeed, it has been recognised that such prior knowledge and experience can sometimes provide an important efficiency advantage, to the benefit of all […]

Insolvency practitioners’ offence reporting

Although the government is trying to distance any connection between wrongdoing and a company going into liquidation or a person becoming bankrupt, the law and policy of insolvency requires a liquidator or trustee to investigate the insolvent’s conduct and refer any offences to the authorities. In contrast, absent the fact of insolvency, no citizen is liable […]

Review of the big banks

The Treasurer has asked the Standing Committee on Economics to inquire into and report on what is termed a Review of Australia’s Four Major Banks. Hearings are commencing this week, in Canberra. The broad terms of reference are: domestic and international financial market developments as they relate to the Australian banking sector and how these […]

The Halcyon Isle resurrected – the law applicable to maritime liens

In a case involving “an important issue for the operation of maritime law in this country” a 5 member bench of the Federal Court has overruled an adventurous decision by a single judge to re-determine a long-contentious issue about the law applicable to maritime liens: Ship “Sam Hawk” v Reiter Petroleum Inc [2016] FCAFC 26. Maritime […]

Liquidators riding a remuneration merry-go-round

The commentaries on how the judges assess, or should assess, the remuneration of liquidators is reaching saturation point, one practitioner likening it to being on a merry-go round – not only between percentage, time and outcome billing methods, but also between state and federal courts. The concept of “proportionality” in assessing the reasonableness of insolvency remuneration is […]

Hanjin Shipping – an Australian perspective

The appointment of a receiver to the large South Korean Hanjin Shipping Line has had an impact in Australia, with parties before the Federal Court last week, 16 September, in relation to the arrest of the ‘Hanjin California,’ presently moored in Sydney Harbour. For legal reasons, one arrest claim was not successful. Hanjin’s receiver […]

Insolvency practitioners’ duties of neutrality

Liquidators and administrators, and trustees, when their appointments are challenged, have a duty of neutrality, to provide relevant facts to parties, and to the court, in order for the concern about the challenge to be determined on its merits. The voluntary administrator’s appointment in Condor Blanco was successfully challenged, and some legal guidance was given […]

Another life insurance inquiry – respond by 18 November…..

The Parliamentary Joint Committee on Corporations and Financial Services is to report by 30 June 2017 on: the need for further reform and improved oversight of the life insurance industry; assessment of relative benefits and risks to consumers of the different elements of the life insurance market, being direct insurance, group insurance and ‘retail advised’ […]

Remuneration of liquidators: Idylic Solutions, Templeton revisited – more of the same?

Judges’ inconsistency of approach in determining the remuneration of corporate insolvency practitioners is continuing. The respective state and federal courts have been ignoring each others’ decisions such that no inconsistency can be said to even arise. When this happened before, as I have explained, the High Court intervened, as school headmaster, to bring into line […]

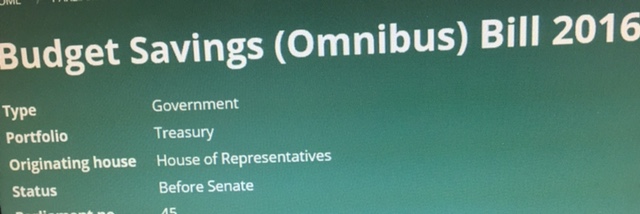

Single touch payroll – on its way into law

The Senate Standing Committee on Economics has given a report on the Budget Savings (Omnibus) Bill 2016 and has endorsed the Bill’s provisions for single touch payroll. The Committee reported: 5.35 Single Touch Payroll (STP) reporting is designed to reduce the compliance costs for employers meeting their Pay as you go (PAYG) withholding obligations by using Standard […]

Consistency in judicial decisions – Marlborough Gold Mines revisited

A rather unsatisfactory situation is developing in the nation’s federal and state superior courts in their exercise of shared jurisdiction under the Corporations Act. This concerns the way that these courts determine the remuneration of corporate insolvency practitioners, about which too much has already been written. There is not only an inconsistency of approach, but the respective […]

QUT insolvency expertise

QUT is holding its international personal insolvency conference in Brisbane tomorrow and Friday – 8-9 September 2016 – with speakers presenting from the US, the UK, Europe, China, South Africa, Japan, New Zealand and more. Leading names in insolvency include Professors Jay Westbrook (US), Iain Ramsay (UK) and Ian Ramsay (Melbourne), along with Professor Rosalind […]

Price signalling in corporate restructuring

In its major review of competition law, the government proposes to remove the price signaling provisions in the Competition and Consumer Act 2010. These provisions, introduced in 2012, had some potential for impact on bank syndicates working on the restructure of a failing or insolvent business, by way of proscribing collective discussions – see s […]

Single touch payroll – disrupting the way things have been done

Single-touch payroll (STP) legislation was introduced into federal parliament on 31 August 2016 through the government’s Budget Savings (Omnibus) Bill 2016. This law would eventually remove unfair reliance by business on what is often said to be “Australia’s largest bank” – the ATO – and lessen the extent to which the ATO is, as at […]