Are pecuniary penalties actually paid?

One enforcement tool of regulators is to obtain a court ordered civil penalty against the respondent company or individual. That then allows the regulator to apply to the court for a ‘pecuniary penalty’ to be imposed. This is ‘a monetary penalty imposed by courts in civil matters where a contravention of a civil penalty provision […]

AFSA’s annual report on personal insolvency?

The AFSA 2023–24 Annual Report has been released, reporting on the information required under particular public sector legislation. Unlike ASIC, AFSA is not required to, and does not, report on particular insolvency matters of interest: see s 136(1)(ca) ASIC Act 2001. While the Inspector-General in Bankruptcy is simply required under section 12(1) of the Bankruptcy […]

Litigation Funding in Insolvency and in Class Actions

This queries corporate insolvency’s requirement for approval of liquidators’ litigation funding in the context of an article comparing litigation funding of insolvency claims and of class actions Over some period of time, I have queried why more law reform and other attention is not given to the connection between funding of class actions and funding […]

Insolvency law reform – and income contributions

A 1997 article about the need for data in insolvency law reform, rather than relying on assumptions and anecdotes unsupported by empirical research, remains as relevant today as then. In a recent case, involving a 2017 bankruptcy discharged in 2020, the Federal Court found that the former bankrupt had received free legal services which constituted […]

Insolvency practitioner remuneration – continued ….

A report in a daily newspaper[1] has commented on the large fees earner by liquidators and administrators in attending to the collapse of some large enterprises, airlines included, in particular those subject to Part 5.3A administration. Without commenting on the particular companies referred to, some perspective always needs to be given to comments about insolvency […]

What is the future of insolvency practice?

In my reply to an interesting comment from a practitioner about the fundamental difficulties of lack of funding for insolvency work, I extracted my commentary of 2021 below about the potential for artificial intelligence (AI) and its offshoots to play an increasing role in insolvency practice. While there will be developments in the past 3 […]

Annotated Bankruptcy Act 10th ed, 2024, LexisNexis

Annotated Bankruptcy Act 1966, 10th edition I am pleased to have had published the 10th edition of the Australian Annotated Bankruptcy Act 1966 by LexisNexis. This work follows on from the considerable input to the book made by the late Paul Nichols whose contribution is readily acknowledged. The book is extracted from Practice and Procedure […]

ASIC’s annual report 2023-2024 – Chapter 5 insolvency issues

ASIC has released its 2023-2024 annual report. ASIC annual reports | ASIC. Under s 136(1)(ca) of the ASIC Act 2001, it is required report on its activities under Chapter 5 of, or Schedule 2 to, the Corporations Act and related provisions. Various issues raised in the report continue to remain the subject of recommendations by […]

The need for a new process for the appointment of insolvency practitioners?

A Judge has expressed concern about the processes for the appointment of insolvency practitioners, suggesting adverse relationships with their lawyers, leading to an abdication of adherence to their duties by practitioners in favour of the pursuit of a “profitable administration”. There is much law and policy background as to issues of independence, remuneration and professional […]

Insolvency trends – should they be higher?

Recent figures show trends in insolvencies in Australia – nothing too significant at a macro level though distressing at a personal level. But perhaps they could or should be higher? in 2023-2024, personal insolvencies totaled around 11,600 compared with 37,000 15 years ago. corporate insolvencies totaled about 11,000 out of 3.4 million companies, slightly higher […]

ASIC’s updated guidance on liquidator registration and discipline; AFSA; and the ART

ASIC has released updated regulatory guidance on statutory committee registration and discipline processes, and related issues: see Revised Regulatory Guide 258 Registered liquidators: Registration, ongoing obligations, disciplinary actions and insurance requirements (RG 258). AFSA provides similar guidance. Reviews of committee decisions will be heard by the new Administrative Review Tribunal from 14 October 2024. This is […]

Gender balance in the insolvency industry

With women comprising only around 10% of insolvency practitioners, the issue of gender balance continues to receive attention, among broader issues of diversity in that sector, and in the workforce generally. The Turnaround Management Association (TMA) has recently launched its TMA Voluntary Code for Equitable Insolvency & Restructuring Appointments (EIRA) under which a Code adopter […]

Reviewing liquidators – under review?

ASIC has announced that it has appointed 15 new members to its Reviewing Liquidator Panel, following the expiry of the 5 year terms of the previous panel members.[1] ASIC can appoint a registered liquidator to act as a reviewing liquidator to a company in external administration under section 90-23 of Schedule 2 of the Corporations Act […]

Coercive control and insolvency

ASIC has asked registered liquidators to “stay alert” for signs of family and domestic violence when conducting insolvency administrations.[1] ASIC explains that any behaviour that is violent, threatening, controlling, or is intended to make a person or that person’s family feel scared and unsafe, can be considered as family and domestic violence. An aspect of […]

Fees of insolvency practitioners and lawyers

The commentary following was issued on 15 August 2021. It is reissued for historic interest only, perhaps, on the assumption that fee relations between lawyers and IPs have improved in the ensuing three years? After Jason Harris and I wrote about Justice Michael Lee’s comments on the high charge out rates of insolvency practitioners, I […]

Personal insolvency figures up and ‘reforms’ pending

Personal insolvencies increased in July 2024, to 1157 compared with the lows of 851 in June 2024, and 929 in July 2023, according to new provisional monthly statistics released by the Australian Financial Security Authority (AFSA). That’s about .0064% of the adult population. The government’s proposed law reforms include to allow debtors to have 7 […]

ASIC’s civil penalty regime – an academic review

In the midst of a focus on the enforcement activity of ASIC following a critical Senate Committee report,[1] we have an article – Penalty Regimes Enforced by the Australian Securities and Investments Commission [2] – which examines the civil penalty regime under the Corporations Act, the ASIC Act and related legislation, and its history. The […]

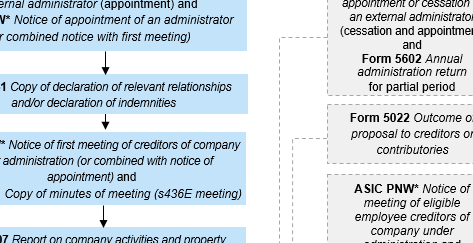

ASIC’s revised guidance on insolvency practitioner offence reporting – RG 16

ASIC has issued revised guidance on insolvency practitioner offence reporting obligations – RG 16 External administrators and controllers: Reporting of possible offences and misconduct, September 2024. 2023 PJC Report on Corporate Insolvency recommendation 19 As I fully explained in April 2024 – ASIC’s review of offence reporting – RG 16 – Murrays Legal, this review […]

Insolvency numbers in decline

Numbers of insolvencies of individuals and companies have fallen dramatically over the years, which we may find represents a fundamental shift away from the formal legal processes involved. That is, of the 3.4 million companies in Australia in 2023-2024, only around 11,000 went into some sort of insolvency administration (0.33%). While this exceeded the […]

$364k mistakenly paid by the ATO to a company in liquidation – retain or return?

In a recent case,[1] C88 Project Pty Ltd, a liquidator was ordered by the Court to return tax moneys of $364,267 paid by the ATO to the company in liquidation by mistake. Various issues were raised, including as to the law of mistake, constructive trusts and the particular tax law provisions. [2] The liquidator had properly […]

Splitting ASIC 2024 and the 2010 Senate Committee Report

In the discussions about separating ASIC’s tasks following the July 2024 Senate Economics References Committee report – Australian Securities and Investments Commission – investigation and enforcement, there has been no mention of the same Senate Economics References Committee’s earlier separation recommendation about ASIC in its 2010 report The regulation, registration and remuneration of insolvency practitioners […]

Some proposed personal insolvency reforms in Australia

With the federal government yet to respond to the PJC Report on corporate insolvency of July 2023, which recommended a general review of both personal and corporate insolvency law, it has nevertheless proceeded to announce personal insolvency reforms and proposals. This may be because the changes involved are fairly routine, and the proposal is consumer […]

Senate report on ASIC’s investigation and enforcement roles – July 2024

The Senate Economics References Committee has issued its Report – Australian Securities and Investments Commission – investigation and enforcement, of 3 July 2024, which is highly critical of ASIC as a corporate regulator and which makes a series of recommendations.[1] One of its main points and recommendations is that ASIC has too much on its […]

“Personal insolvencies increased in May 2024…” – by 3

AFSA reports that “personal insolvencies increased in May 2024”. They did – by 3 more than in April 2024. Personal insolvency numbers increased by only 3 more in May 2024 (1049) than in April 2024 (1046), and only 18 more than in May 2023 (1031). Provisional personal insolvencies increased in May 2024 | Australian Financial […]