articles

NZ insolvency reform – gift cards, director identity numbers, voidable transactions, Ponzi schemes, and more

17/05/2017

New Zealand safe harbour articles Case law

New Zealand does well in its insolvency law reform, partly assisted by not being a federation (no Linc Energy surprises),

APES 110 – accountants, whistleblowers and safe harbour advisers to note

12/05/2017

international NOCLAR AFSA APES 110

Increased professional obligations of accountants, and insolvency practitioners, to refer breaches of the law to the authorities, are being considered at

Gift-cards resurrected

04/05/2017

articles commentary gift cards international

The 2016 “gift-card” report of the UK Law Commission examined whether there should be greater protection for consumers who lose

Mental health and bankruptcy

19/04/2017

articles Case law commentary Insolvency profession

The account of the bankruptcy of Sir Garfield Barwick and the personal impact that it had on him is a

Law reform – a carve-out from directors’ insolvent trading liability, with a change in their culture in return

02/04/2017

articles commentary Law reform safe harbour

The draft ‘safe harbour’ provisions proposed by the government offer directors two advantages in what must be their genuine attempts

ASIC’s industry funding model – draft laws

23/02/2017

AFSA articles ASIC commentary

Drafts of ASIC’s Supervisory Cost Recovery Levy Bill 2017 and related Bills have been released for comment, by 10 March

The Law in the Insolvency “Law” Reform Act 2016

14/02/2017

registration articles Case law commentary

The law has not been given much attention in the recent CLE and professional offerings on the new insolvency laws, with their

Egon Kisch and Albert Piddington

10/02/2017

articles Australian Academy of Law Case law commentary

The name Egon Kisch may not be familiar to many but a recent talk given at an event held by

Insolvency Law Reform Act 2016 – more unpaid work for liquidators?

14/01/2017

articles commentary Law reform no funds

ARITA has reported that the ILRA 2016 imposes a significantly broader range of reporting obligations on liquidators than indicated in

If there is little money in the winding up, the liquidator will have to cut corners he might not otherwise cut

13/01/2017

articles Case law commentary no funds

Insolvency practitioners have the choice to take on a liquidation or a bankruptcy and therefore must accept that there will

ASIC before the Senate – no more scalps, goodness will prevail; complaints in the “thousands”; and the ASIC database

29/10/2016

articles ASIC commentary General

Senate questioning of ASIC does provide some useful information at times. In the inquiry into ASIC’s 2015 annual report by

Insolvency practitioners’ offence reporting

10/10/2016

offences technology AFSA APESB

Although the government is trying to distance any connection between wrongdoing and a company going into liquidation or a person

Review of the big banks

03/10/2016

articles commentary Law reform

The Treasurer has asked the Standing Committee on Economics to inquire into and report on what is termed a Review

The Halcyon Isle resurrected – the law applicable to maritime liens

28/09/2016

articles Case law commentary Halcyon Isle

In a case involving “an important issue for the operation of maritime law in this country” a 5 member bench of

Liquidators riding a remuneration merry-go-round

25/09/2016

articles ASIC commentary remuneration

The commentaries on how the judges assess, or should assess, the remuneration of liquidators is reaching saturation point, one practitioner likening it

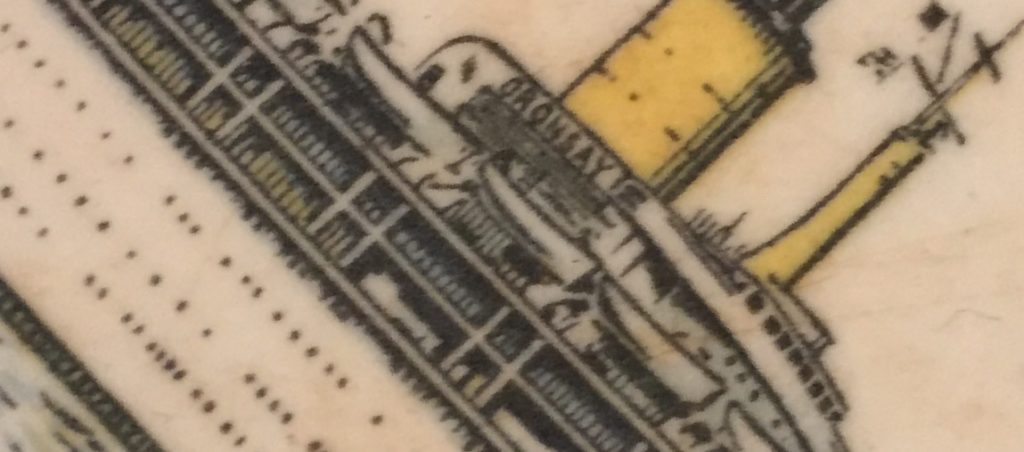

Hanjin Shipping – an Australian perspective

19/09/2016

articles Case law commentary Hanjin

The appointment of a receiver to the large South Korean Hanjin Shipping Line has had an impact in Australia, with

Insolvency practitioners’ duties of neutrality

16/09/2016

articles Case law commentary duties of IPs

Liquidators and administrators, and trustees, when their appointments are challenged, have a duty of neutrality, to provide relevant facts to

Another life insurance inquiry – respond by 18 November…..

16/09/2016

APRA articles commentary crisis management

The Parliamentary Joint Committee on Corporations and Financial Services is to report by 30 June 2017 on: the need for

Remuneration of liquidators: Idylic Solutions, Templeton revisited – more of the same?

16/09/2016

articles Case law commentary remuneration

Judges’ inconsistency of approach in determining the remuneration of corporate insolvency practitioners is continuing. The respective state and federal courts

Single touch payroll – on its way into law

15/09/2016

articles commentary Law reform Senate report

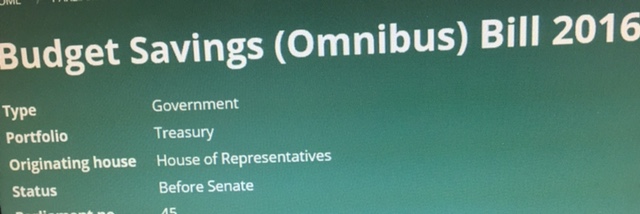

The Senate Standing Committee on Economics has given a report on the Budget Savings (Omnibus) Bill 2016 and has endorsed the Bill’s

Consistency in judicial decisions – Marlborough Gold Mines revisited

12/09/2016

articles Case law commentary Law reform

A rather unsatisfactory situation is developing in the nation’s federal and state superior courts in their exercise of shared jurisdiction

Price signalling in corporate restructuring

06/09/2016

articles commentary Competition and Consumer Act Law reform

In its major review of competition law, the government proposes to remove the price signaling provisions in the Competition and

Single touch payroll – disrupting the way things have been done

04/09/2016

ANAO articles Case law commentary

Single-touch payroll (STP) legislation was introduced into federal parliament on 31 August 2016 through the government’s Budget Savings (Omnibus) Bill

Gaps and weaknesses in our system of financial regulation

03/09/2016

APRA articles Case law commentary

The government is yet to respond to weaknesses in our laws that deal with the financial distress or collapse of

Categories

Main Menu