woodfer

The changes effected by the Insolvency Law Reform Act 2016 are now law with some parts having commenced on 1 March 2017 with the remainder on 1 September 2017.

Any new law causes some disruption but it can also serve to clean out some of the old ways, in particular those in corporate insolvency, and the harmonisation of many aspects of insolvency practice will in due course be seen as a benefit, ASIC and AFSA continuing to go their own separate ways notwithstanding.

While there are concerns about the drafting, and what one international conference last week referred to as Australia’s “over-engineered” drafting and policy approach, these changes are not legally complex, save for those who want to see them so.

The problem is that the focus is and has been on the wood of forms and process without seeing real issues up in the trees.

A vent, but a serious one

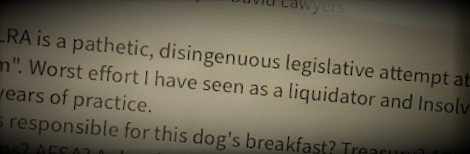

We will soon all have to leave the venting behind, but when a pre-eminent Australian lawyer and insolvency practitioner describes the new law as

“a pathetic, disingenuous legislative effort at ‘law reform’”,

in fact the

“worst effort I have seen as a liquidator and insolvency lawyer in 35 years of practice”,

who goes on to ask

“who is responsible for this dog’s breakfast?”

answering that with various options involving

drunkenness, comedy, and narcissism,

concluding with the serious comment that

“the losers are the liquidators, the judiciary, creditors and the public at large”,

things are serious.

Having said that, the law is in place. While odd drafting and inconsistencies do exist, the law, and judges, and lawyers, all have a way of dealing with them.

How did it happen?

One task may be, through academic research, theses, and retrospectives, to analyse how it all happened and, if relevant, who is responsible. In short order, the government, and its quality; ASIC, followed (literally) by AFSA; the populist media; and the ‘industry’? My thesis will follow.

Concerns

Some of my serious arboreal concerns that have not been the subject of proper scrutiny, and which go to the legal protection of the professionals themselves, are and remain these:

- A discipline committee that is referred a discipline matter by ASIC or AFSA under s 40-50 of the Schedules is given no statutory grounds upon which to decide what if any misconduct of the practitioner occurred, merely a series of penalties, as if guilt were assumed: s 40-55.

- Such a committee is given the authority to informally decide, without reference to the practitioner, not to grant an interview, and make a decision regardless, on the papers: s 50-80 Rules.

- A trustee in bankruptcy can legitimately refuse to respond to directions, show-cause notices and committee inquiries, relying upon the common law penalty privilege: Rich v ASIC [2004] HCA 42. That privilege was, properly, removed for the new discipline processes for liquidators: s 1349 Corporations Act. It was not removed in bankruptcy.

- Given the new roles of ARITA, CPA Australia, CAANZ and IPA, as “industry bodies”, whose initiation of a referral of a practitioner to AFSA or ASIC may lead to a penalty being imposed on that practitioner, are those industrial bodies themselves subject to the privilege?

- The law appears to allow those industry bodies to refer an insolvency practitioner’s conduct to the regulators without notice to the practitioner. That decision is subject to judicial challenge: s 40-100, but only if the practitioner knows the referral has occurred. The industry bodies have issued no guidance on how they will exercise these powers.

- Once a referral is made to ASIC, ASIC says it will put the claimed misconduct notice on its public data base. But if a referral is made to AFSA, it will be kept private.

- Those industry bodies may receive confidential misconduct information from the regulators, with little guidance as to the use of that information, save for severe penalties for misuse.

- Confidential discipline committee information may be disclosed by an ARITA nominated committee member back to any of the industry bodies: s 50-35 Schedules; and

- The words ‘minutes of meetings of creditors’ in Corporations Rules s 75-145 are misleading but the words ‘minutes of meetings of creditors’ in s 75-145 Bankruptcy Rules are not.

More soon….