Another life insurance inquiry – respond by 18 November…..

The Parliamentary Joint Committee on Corporations and Financial Services is to report by 30 June 2017 on: the need for further reform and improved oversight of the life insurance industry; assessment of relative benefits and risks to consumers of the different elements of the life insurance market, being direct insurance, group insurance and ‘retail advised’ […]

Remuneration of liquidators: Idylic Solutions, Templeton revisited – more of the same?

Judges’ inconsistency of approach in determining the remuneration of corporate insolvency practitioners is continuing. The respective state and federal courts have been ignoring each others’ decisions such that no inconsistency can be said to even arise. When this happened before, as I have explained, the High Court intervened, as school headmaster, to bring into line […]

Single touch payroll – on its way into law

The Senate Standing Committee on Economics has given a report on the Budget Savings (Omnibus) Bill 2016 and has endorsed the Bill’s provisions for single touch payroll. The Committee reported: 5.35 Single Touch Payroll (STP) reporting is designed to reduce the compliance costs for employers meeting their Pay as you go (PAYG) withholding obligations by using Standard […]

Consistency in judicial decisions – Marlborough Gold Mines revisited

A rather unsatisfactory situation is developing in the nation’s federal and state superior courts in their exercise of shared jurisdiction under the Corporations Act. This concerns the way that these courts determine the remuneration of corporate insolvency practitioners, about which too much has already been written. There is not only an inconsistency of approach, but the respective […]

QUT insolvency expertise

QUT is holding its international personal insolvency conference in Brisbane tomorrow and Friday – 8-9 September 2016 – with speakers presenting from the US, the UK, Europe, China, South Africa, Japan, New Zealand and more. Leading names in insolvency include Professors Jay Westbrook (US), Iain Ramsay (UK) and Ian Ramsay (Melbourne), along with Professor Rosalind […]

Price signalling in corporate restructuring

In its major review of competition law, the government proposes to remove the price signaling provisions in the Competition and Consumer Act 2010. These provisions, introduced in 2012, had some potential for impact on bank syndicates working on the restructure of a failing or insolvent business, by way of proscribing collective discussions – see s […]

Single touch payroll – disrupting the way things have been done

Single-touch payroll (STP) legislation was introduced into federal parliament on 31 August 2016 through the government’s Budget Savings (Omnibus) Bill 2016. This law would eventually remove unfair reliance by business on what is often said to be “Australia’s largest bank” – the ATO – and lessen the extent to which the ATO is, as at […]

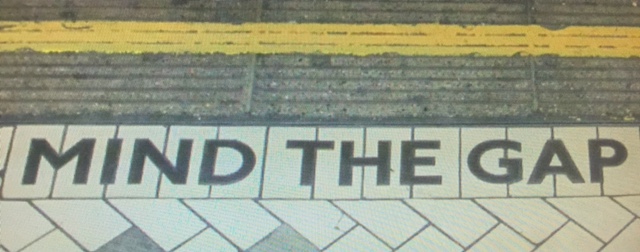

Gaps and weaknesses in our system of financial regulation

The government is yet to respond to weaknesses in our laws that deal with the financial distress or collapse of financial institutions – banks, insurers, life companies and more. Some of these weaknesses and gaps were identified over 5 years ago and were the subject of a major government consultation paper in 2012. In 2015, […]

Consolidated version of the new Bankruptcy Act 1966

CCH is publishing a consolidated version of the Bankruptcy Act 1966 as amended by the Insolvency Law Reform Act 2016. The amended law does not commence until 2017 but given the substantial changes being made, this publication will allow preparation and familiarity with the law many months before for the expected commencement dates. As we […]

Condor Blanco – three useful propositions

This decision in Condor Blanco Mines Ltd [2016] NSWSC 1196 is important for three propositions: In general, it is not part of a voluntary administrator’s responsibility, in deciding to take an appointment or later assessing its the validity, to delve into any improper purpose or motive of the directors beyond that of using Part 5.3A as a response […]

Inquiries x 3: small business lending; external dispute resolution; financial ombudsman service

1. Inquiry into small business lending practices The Australian Small Business and Family Enterprise Ombudsman will undertake an inquiry into concerns raised by the Parliamentary Joint Committee (PJC) on Corporations and Financial Services in its report, Impairment of Customer Loans. That report, tabled on 4 May 2016, made a number of recommendations including this reference […]

New Zealand – the outlier of international insolvency regulation

Australia and other countries will be relieved that New Zealand is again looking at licensing and regulating its insolvency practitioners. From a cross-border perspective, this relief is in light of the fact that an unqualified NZ liquidator has the right to pursue cross-border insolvency investigations, conduct examinations and take court proceedings in Australia without the […]

A silver lining in the insolvency law reform delay

The unfortunate delay in the commencement of the substance of the insolvency law reforms for one year, to 1 September 2017, and the reasons given for this may in fact reveal a silver lining, an opportunity to bring insolvency processes on-line and into the 21st century. The government has acceded to the need for practitioners […]

The right to vote out under-performers – liquidators, politicians and ICAC

Insolvency practitioners are to be the subject to the same tenure arrangements as federal politicians, with creditors being able to vote out “underperforming practitioners”, but, unlike federal politicians, practitioners are also to be subject to ICAC type oversight. Minister Kelly O’Dwyer, in referring to the Insolvency Law Reform Act 2016, says that creditors’ right to remove […]

Latest Supreme Court Views on Liquidators’ Remuneration

A NSW Supreme Court judge has spoken about “liquidators’ preference for time-based remuneration, and courts’ scepticism of it” at a major conference of senior judges and lawyers in Sydney last week. Justice Ashley Black presented his paper at the Conference on Corporations Law held by the Federal Court of Australia and the Law Council. Federal Court Judges and senior […]

Insolvency reforms further delayed

The Australian government has decided that insolvency practitioners need more time to implement long awaited law reforms aimed at improving practitioners’ reporting and accountability, enhancing their efficiency, improving their communications and increasing competition between them. The commencement of many of the reforms under the Insolvency Law Reform Act 2016 (ILRA), which became law on 29 February 2016, are being […]

Liquidators’ remuneration further explained …

Obviously with an eye on the ‘controversy’ over how to assess liquidator’s remuneration, at least in NSW, Justice Robb of that Supreme Court has given a judgment that seeks to explain the place that using a percentage of asset realizations has in determining a liquidator’s remuneration. At the same time the Judge raised another issue, said to be […]

Director identity numbers, and their frequent flyer equivalents

Among all the numerous recommendations the government has received about corporate insolvency reform, one has now been made three times – the need for a director identity number, a DIN. The need for that needs to be highlighted as one answer to the control of illegal phoenix activity. However recent media and other comment about […]

ASIC’s database, the Productivity Commission and Phoenix misconduct

Three stars have aligned this August – the Productivity Commission’s inquiry into data usage, the government’s pending decision on how to make more money out of ASIC’s corporate data, and ASIC’s and the ATO’s media campaigns against unlawful phoenix activity – conveniently now prompting this focus on the various connections between them. One reason the […]

Misprision revived – accountants’ new legal obligations – APESB

Accountants are taking on an obligation to refer breaches of the law to the authorities, under changes to their international code of ethics, reviving an obligation assessed and addressed by the law some time ago. Professional ‘accountants’ are bound by the International Code of Ethics for Professional Accountants, maintained by IESBA. The obligation to respond to ‘non-compliance […]

A lack of trust in the law of trusts

Joint liquidators had to apply to the court be appointed as receivers and managers of property held by them as bare trustee because of uncertainty in the law as to their powers. The company had never traded in its own right, its only activity having been to act as trustee and to carry on the […]

Singapore’s new debt restructuring regime – the steak knives are out

Competition between courts and the legal regimes in which they operate is perhaps an odd concept, contrary to the image of the strict independence and objectivity expected of our judicial system and its officers. It does exist, at various levels, and is perhaps reinforced by individuals’ inherent competitiveness for territory and status. The apocryphal […]

The Fishman’s non-payment of tax was not dishonest

The Fish Man Ltd was in liquidation. Its director, Mr Hadfield, raised and sold ornamental fish from 14 fish tanks at his home. But one day he cut his finger and, for a time, could not work. Sadly, this ultimately led to the Fish Man not being able to meet its PAYE and GST liabilities, and going […]

Gift cards, and Christmas hampers

A report has just been issued in the UK by the Law Commission on the question of whether there should be greater protection for consumers who lose deposits or gift vouchers when retailers or other service providers go into insolvency. Dick Smith Electronics This mirrors a Senate Committee inquiry in Australia into gift vouchers […]